As cryptocurrency trading continues to evolve, users and investors are increasingly looking for platforms that offer the best of both centralized and decentralized exchanges. Hybrid crypto exchange development is an innovative solution that blends the high liquidity and speed of centralized systems with the privacy and control found in decentralized exchanges. In this guide, we explore what hybrid crypto exchanges are, how they work, and why they are the future of crypto trading.

What is Hybrid Crypto Exchange Development?

Hybrid crypto exchange development involves building a platform that combines elements of both centralized and decentralized exchanges. Centralized exchanges (CEX) are known for their speed, liquidity, and user-friendly interfaces, while decentralized exchanges (DEX) focus on user control, privacy, and security. By merging these features, a hybrid crypto exchange aims to provide a seamless trading experience that offers the best of both worlds.

How Hybrid Crypto Exchanges Work

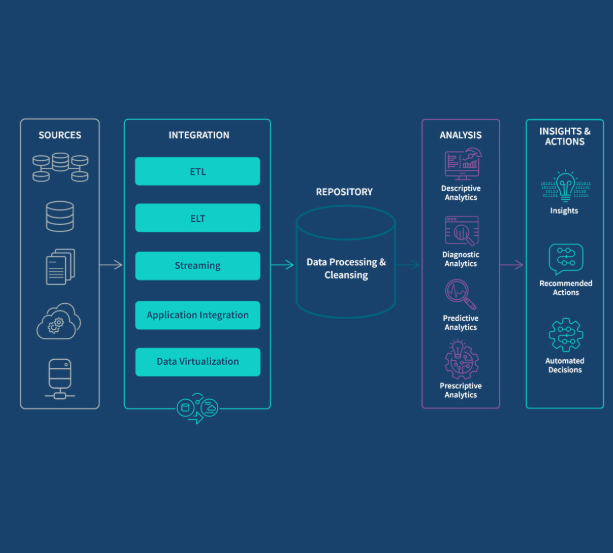

Hybrid crypto exchanges operate with a dual-layered structure that integrates both centralized and decentralized components. This setup allows users to enjoy the advantages of both models while minimizing the drawbacks.

- Centralized Functions: The centralized layer of a hybrid exchange handles key functions like high-speed order matching, liquidity management, and compliance with regulations. Centralized exchanges typically offer fast transaction speeds, deep liquidity pools, and built-in Know Your Customer (KYC) and Anti-Money Laundering (AML) measures.

- Decentralized Functions: The decentralized layer enhances privacy and security by enabling users to retain full control over their digital assets. Through smart contracts, users can execute trades directly from their wallets, eliminating the need for intermediaries. This layer also supports peer-to-peer (P2P) transactions, which promote transparency and fairness.

The hybrid structure merges these two components to create a unified platform where users can access fast trading speeds and liquidity, all while maintaining control over their assets.

Key Features of a Hybrid Crypto Exchange

Hybrid exchanges combine the best features of centralized and decentralized exchanges. Here are the key attributes that make them stand out:

- High Liquidity and Speed: Hybrid platforms offer quick order matching and access to deep liquidity pools, inherited from centralized exchanges. This ensures fast execution of trades, which is especially important for professional traders engaging in margin trading.

- Enhanced Security: Unlike centralized platforms that store funds in a custodial wallet, hybrid exchanges utilize non-custodial wallets, reducing the risk of hacks. Users maintain control of their private keys, which adds an extra layer of security.

- Regulatory Compliance: Hybrid exchanges are built with modular compliance frameworks, allowing them to meet the regulatory requirements of different regions. They often include automated KYC and AML systems, making them suitable for institutional investors and compliant with global financial regulations.

- User Control and Autonomy: With hybrid exchanges, users have full control over their funds and can trade directly from their wallets without depositing assets onto the platform. This approach appeals to privacy-conscious traders and aligns with the core principles of decentralization.

- Interoperability and Scalability: Many hybrid exchanges support multiple blockchain networks and token standards, such as ERC-20 and BEP-20. This ensures cross-chain trading and enhances the scalability of the platform, making it adaptable to evolving market demands.

- Customizability and White Label Solutions: Hybrid exchanges offer flexible architecture, which is ideal for businesses looking to launch branded platforms. Pre-built features like admin dashboards, multi-currency wallets, and real-time analytics can be easily customized to suit the needs of individual crypto businesses.

Comparing Exchange Types

To understand the value of hybrid exchanges, it’s essential to compare them with traditional centralized and decentralized exchanges:

- Centralized Exchanges (CEX): These exchanges provide high liquidity, fast transactions, and are regulated. However, they require users to trust the platform with their funds, which introduces custodial risks.

- Decentralized Exchanges (DEX): DEXs offer users full control over their funds and prioritize privacy. However, they often face challenges related to liquidity and slower transaction speeds.

Hybrid exchanges combine the strengths of both systems, providing high-speed trading with decentralized control and security.

Use Cases and Advantages of Hybrid Crypto Exchanges

Hybrid crypto exchanges have numerous applications and advantages that make them essential in today’s crypto landscape:

- Access to Multiple Trading Options: Hybrid exchanges integrate various trading options, including spot trading, crypto derivatives, and tokenized assets, all in one platform. This versatility attracts both retail and institutional traders.

- P2P Transactions with Liquidity: Hybrid platforms address the liquidity challenges of decentralized exchanges by incorporating liquidity pools from centralized exchanges, allowing for secure P2P trading with minimal wait times.

- OTC and Margin Trading: Hybrid platforms support over-the-counter (OTC) services for large trades and margin trading, offering a comprehensive suite of features for both institutional clients and experienced traders.

Critical Factors in Hybrid Crypto Exchange Development

Creating a successful hybrid exchange involves several critical factors that developers and stakeholders must consider:

- Choosing the Right Development Partner: Selecting an experienced cryptocurrency exchange development company is crucial. Look for a partner with expertise in both centralized and decentralized systems, compliance, and scalability.

- Platform Architecture: A hybrid exchange needs a flexible architecture that allows for seamless integration of both centralized and decentralized components. This ensures system performance, scalability, and easy updates.

- AI and Automation: Integrating AI-powered tools can enhance trading security, detect abnormal activities, and optimize liquidity. AI can also automate compliance checks and enhance the overall user experience.

Cost of Development

The cost of developing a hybrid crypto exchange depends on factors such as the complexity of features, UI/UX design, and regulatory compliance. A basic white-label solution might cost between $50,000 and $100,000, while a fully customized enterprise-level platform could exceed $250,000.

Key Components of a Hybrid Exchange

A successful hybrid exchange requires a combination of essential modules from both centralized and decentralized systems:

- User Dashboard: For managing balances, trades, and account information.

- Admin Panel: For managing liquidity, users, and compliance reports.

- KYC/AML Module: To ensure regulatory compliance.

- Order Matching Engine: For facilitating real-time trading.

- Wallet System: Supporting multi-currency storage, including hot and cold wallets.

- Smart Contract Integration: For decentralized trading.

- Analytics and Reporting: To provide insights into trades, volume, and user behavior.

Trends Shaping the Future of Hybrid Exchanges

The development of hybrid exchanges is influenced by emerging trends in the crypto industry:

- Integration with Web3 and DeFi ecosystems

- Support for tokenized real-world assets

- AI-driven trading bots and automation

- Mobile-first UI/UX designs

- Cross-chain interoperability

These trends position hybrid exchanges as the go-to platform for the next generation of crypto traders.

Why Go Hybrid?

For businesses deciding between building a centralized or decentralized exchange, going hybrid offers the best of both worlds. Hybrid exchanges provide:

- Speed and liquidity for active traders.

- Security and control for cautious investors.

- Compliance and transparency for regulators.

Partnering with an experienced development company ensures that your platform is built to meet industry standards and market demands.

Conclusion

Hybrid crypto exchange development is transforming the cryptocurrency trading landscape. By combining the strengths of centralized and decentralized exchanges, hybrid platforms offer a comprehensive solution for traders and investors. Whether you’re an entrepreneur looking to launch a new exchange or an established platform seeking an upgrade, the hybrid model provides a scalable, secure, and user-friendly trading experience. As the crypto market matures, hybrid exchanges will continue to lead the way in offering the best trading solutions for all users.