The decentralized nature of Web3 brings with it new approaches to creating, managing, and scaling business models. Unlike traditional Web2 ecosystems, Web3 projects leverage blockchain technology to foster transparency, decentralization, and community-driven growth. However, simply using these technologies isn’t enough to ensure long-term success. A robust Web3 business model must integrate technical innovation with incentives that align with sustainable practices. In this article, we explore the core components that support a successful and sustainable Web3 business.

Tokenomics: The Foundation of Web3

Tokenomics, or the design and economics behind a project’s native token, is one of the most vital components of any Web3 business. Tokens represent more than just a fundraising tool; they are a key driver of engagement, governance, and the value within a blockchain ecosystem.

A well-designed token should serve various functions—such as acting as a medium of exchange, a store of value, or a governance mechanism. For example, utility tokens provide access to a platform’s services, while governance tokens allow users to participate in decision-making. The balance between supply, demand, and inflation must be carefully managed to ensure that the token maintains its value over time.

Moreover, tokenomics plays a critical role in incentivizing both users and developers. Staking, yield farming, and liquidity mining are some of the ways Web3 projects encourage participation. Meanwhile, deflationary models—such as token burns—can create scarcity and enhance the perceived value of the token.

Poorly executed tokenomics, however, can lead to inflation, token dumping, or a lack of practical utility, which may result in user distrust and disengagement. Therefore, Web3 businesses must carefully balance token supply, demand, and utility to achieve sustainable growth.

Governance and Community Involvement

A key principle of Web3 is decentralization, with decentralized governance through mechanisms like Decentralized Autonomous Organizations (DAOs). DAOs allow the community to make crucial decisions, such as funding allocations, project direction, and protocol upgrades. This community-centric approach ensures that projects remain aligned with the interests of their users and token holders, promoting long-term engagement.

However, DAOs can present challenges. Voting power often scales with token holdings, which can lead to “governance capture” by larger holders, and decision-making can be slower than in traditional, centralized systems. To address this, many projects adopt hybrid governance models that combine decentralization with leadership from experienced teams, striking a balance between community input and operational efficiency.

Revenue Generation Models

For a Web3 business to be sustainable, it must generate consistent revenue to fund its development and operations. Unlike traditional Web2 companies that often rely on advertising, Web3 projects leverage blockchain-native revenue streams.

- Transaction Fees: Many decentralized applications (dApps) earn revenue by charging minimal transaction fees. Users pay these fees when interacting with the blockchain, whether for sending tokens, trading, or executing smart contracts. While the fees are typically small, they can accumulate as transaction volumes grow.

- Staking Rewards: Staking allows users to lock their tokens in a network, securing it while earning rewards in return. This incentivizes long-term token holding and helps maintain the stability of the network.

- Premium Services: Some Web3 projects offer tiered services, such as premium features or early access to new tools. By providing additional value to more engaged users, businesses can diversify their revenue streams.

- Protocol Revenue: In certain cases, the protocol itself earns a percentage of the value transacted on the platform, such as through fees from automated market makers (AMMs) or lending interest.

To thrive in the rapidly evolving blockchain space, Web3 businesses need adaptable and scalable revenue models that can evolve with the market.

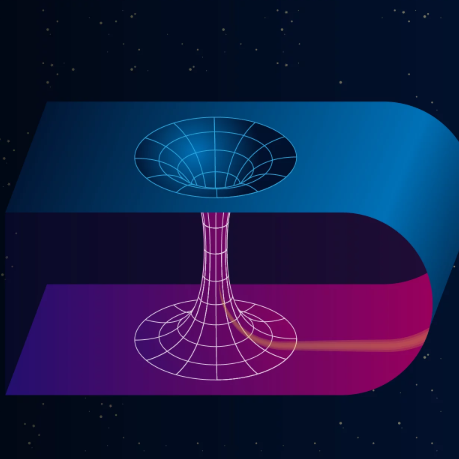

Interoperability: A Competitive Advantage

Interoperability is essential for the long-term success of Web3 businesses. As blockchain ecosystems expand, it’s clear that no single blockchain can meet the needs of all users. Projects that can operate across multiple blockchains via cross-chain bridges or multi-chain protocols will hold a significant advantage.

By enabling smooth communication and interaction between different blockchains, interoperability increases liquidity, market access, and user experience. DeFi platforms that work across multiple blockchains, for example, can offer a broader range of assets and trading pairs, enhancing engagement.

Achieving true interoperability, however, is a complex challenge. There are technical and security hurdles that must be overcome to ensure that different chains can work seamlessly together. Projects that successfully navigate these challenges will be well-positioned to thrive in a multi-chain world.

Challenges in Building Sustainable Web3 Models

While Web3 offers vast opportunities, building a lasting business model isn’t without its challenges. Several factors can impede long-term growth and stability in this space.

Regulatory Uncertainty

Web3 operates in a highly uncertain regulatory environment. Blockchain and cryptocurrencies are still relatively new, and governments are still figuring out how to regulate them. This uncertainty can deter institutional investors and limit the scalability of projects.

Compliance with existing financial regulations is another challenge. As laws evolve, businesses must remain agile to comply with local regulations while preserving their decentralized nature.

User Retention in a Volatile Market

The cryptocurrency market is notorious for its volatility, and user retention can be difficult when prices fluctuate dramatically. Speculative users may quickly abandon a project during price dips. To build a loyal user base, Web3 businesses must focus on offering real value beyond financial incentives, such as long-term engagement and a sense of community.

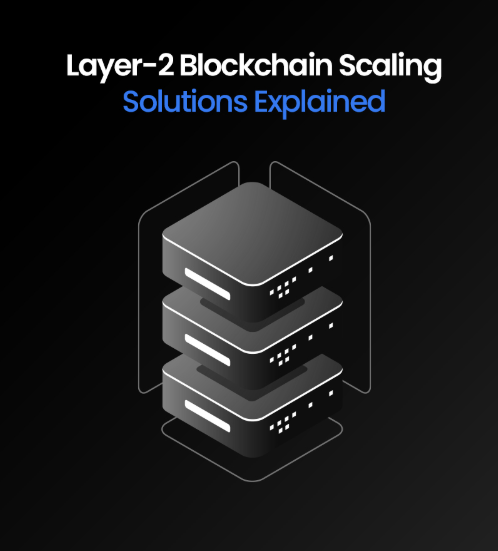

Scalability and Infrastructure Stability

Blockchain technology is still maturing, and scalability remains a significant issue. Problems like high transaction costs, network congestion, and slow transaction speeds can hamper user experiences and delay mainstream adoption.

Web3 businesses must focus on ensuring their infrastructure is scalable and resilient to handle growing demand. Solutions like layer-2 scaling, sidechains, and sharding are being explored to address these issues, but businesses will need to continue adapting as the technology matures.

Balancing Decentralization with Efficiency

Although decentralization is one of Web3’s foundational principles, it can conflict with the need for efficient governance. In fully decentralized systems, decision-making can be slow and cumbersome, hindering progress.

Projects must find a balance between decentralized governance and operational efficiency. Hybrid models that combine community involvement with experienced leadership can ensure both transparency and effective decision-making.

Conclusion

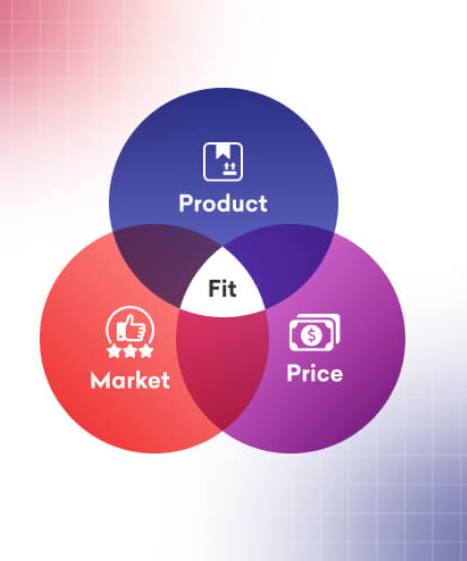

Creating a sustainable Web3 business model requires a careful combination of tokenomics, governance, revenue generation, and interoperability. By addressing the unique challenges of Web3—such as regulatory uncertainty, scalability, and governance inefficiencies—projects can create lasting value. The future of Web3 will belong to businesses that balance innovation with sustainability, positioning themselves for long-term success in an increasingly decentralized world.