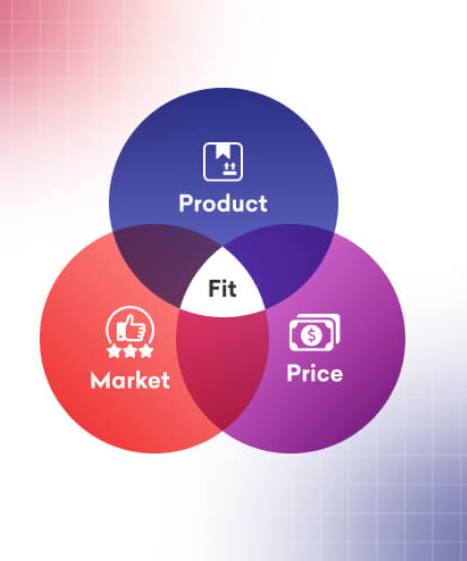

Building a successful token economy can be a daunting task, and unfortunately, many tokenized projects fail. While market conditions and product-market fit certainly play a role, the root cause often lies in poor token design—specifically how tokens are allocated and how incentives are structured. Many projects adopt a simple, static token allocation model, dividing tokens between teams, investors, and liquidity pools, without considering user behavior, long-term sustainability, or psychological incentives.

As a result, even projects with great potential can struggle. The token price drops, adoption slows, and eventually, the economy collapses under its own weight. For token economies to succeed, they need a deeper understanding of the game theory behind user behavior. By aligning token incentives with user actions, founders can create systems that drive both the protocol and token success.

Why Token Economies Fail and How to Fix Them

Game Theory in Token Design

Game theory helps predict how individuals will behave in different situations, especially when their actions affect others. For token economies, these models can provide invaluable insights into how to structure incentives, encourage cooperation, and ensure long-term value creation. Let’s explore how game theory can help design better token economies by looking at different models used in various sectors.

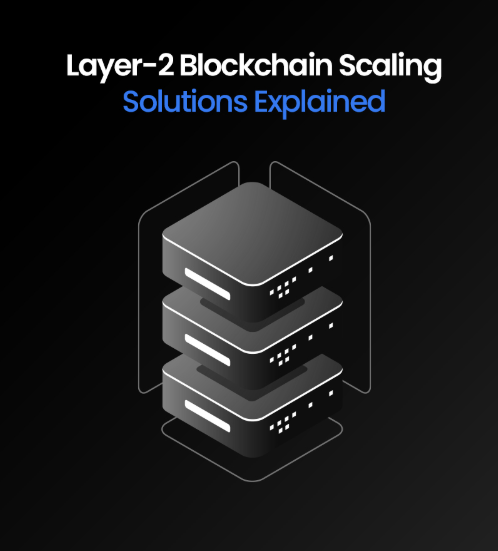

1. Liquidity-Based Economies: Encouraging Long-Term Liquidity

The Problem:

Decentralized Finance (DeFi) protocols depend heavily on liquidity. However, liquidity providers (LPs) often withdraw their funds when rewards decrease, causing instability.

Game Theory Model: Prisoner’s Dilemma

In this scenario, cooperation would involve LPs leaving their funds in the liquidity pool, benefiting the protocol. Defection would be withdrawing liquidity, leading to instability.

Solution:

- Incentives for Cooperation: Offer rewards that increase with the duration of liquidity lock-ups. For example, provide higher token rewards for liquidity provided for 30, 90, or 180 days.

- Penalties for Defection: Introduce withdrawal fees for early exits, discouraging opportunistic behavior.

- Token Utility: Use governance tokens to give LPs a voice in protocol decisions, aligning their interests with the protocol’s growth.

2. Contribution-Based Economies: Rewarding Community Contributions

The Problem:

In systems where tokens are earned through contributions (like staking, validating, or developing), it can be difficult to sustain engagement while ensuring fairness.

Game Theory Model: Zero-Sum Game

In contribution-based models, one participant’s gain might seem like another’s loss, requiring careful balance to foster both competition and collaboration.

Solution:

- Fair Reward Distribution: Tokenize contributions, rewarding validators and stakers based on transparent metrics such as uptime or blocks validated.

- Fostering Healthy Competition: Introduce leaderboards and reward top contributors with NFTs or bonus tokens.

- Collaboration Mechanisms: Create staking pools that allow participants to share rewards, blending cooperation with competition.

3. GameFi Economies: Incentivizing Play-to-Earn Models

The Problem:

Play-to-earn (P2E) economies often suffer from inflationary token models. When too many tokens are issued, their value dilutes, and players may prioritize short-term rewards (selling tokens) over long-term engagement.

Game Theory Model: Stag Hunt

In GameFi, players face the choice between collaborating for a larger reward (hunting the stag) or playing solo for smaller, guaranteed rewards (hunting the hare).

Solution:

- Incentivizing Cooperation: Create quests or events that require teamwork, with larger rewards for collaboration.

- Anti-Inflation Mechanisms: Implement token sinks, such as in-game upgrades or staking, to decrease the circulating supply.

- Token Utility: Use tokens for in-game purchases, governance, or staking to unlock additional features.

4. Learning Economies: Rewarding Knowledge Sharing

The Problem:

Learn-to-earn platforms incentivize users to consume educational content but often fail to reward content creators or peer-to-peer learning, limiting engagement and retention.

Game Theory Model: Nash Equilibrium

In this model, users must balance individual learning (earning tokens for consuming content) with collective learning (creating and sharing content).

Solution:

- Reward Both Learners and Creators: Offer token rewards for watching educational content, completing quizzes, and creating content.

- Reputation-Based Incentives: Introduce reputation tokens for top content creators, unlocking exclusive perks and higher earning potential.

- Token Utility: Use tokens for premium courses, certifications, or consultations.

5. Lending Economies: Encouraging Timely Repayments

The Problem:

Lending protocols often struggle to encourage timely repayments while penalizing defaults, relying too heavily on penalties.

Game Theory Model: Behavioral Economics

This model suggests that incentives can nudge users towards desirable behaviors, such as repaying loans on time.

Solution:

- Incentivize Early Repayments: Offer token rebates or rewards for borrowers who repay their loans ahead of the due date.

- Penalty for Defaults: Increase penalties for late payments or defaults to discourage risky behavior.

- Token Utility: Allow borrowers to stake governance tokens as collateral, aligning their success with the protocol’s growth.

A Unified Approach to Token Design

For founders building token economies across sectors like DeFi, GameFi, and others, applying game theory can guide the creation of sustainable ecosystems. Here’s a framework to follow:

- Understand User Behavior: Map out user motivations and actions. Use surveys or beta tests to predict behaviors.

- Choose the Right Game Theory Model: Select models like Prisoner’s Dilemma, Stag Hunt, or Nash Equilibrium depending on your economy.

- Design Reward Structures: Align user actions with protocol growth through incentives that balance short-term rewards with long-term sustainability.

- Tokenize Incentives: Use fungible tokens for scalable rewards and NFTs for unique incentives.

- Iterate and Optimize: Continuously monitor user behavior and adjust incentives to optimize outcomes.

A successful token economy is more than just about allocation—it’s about understanding how to engineer behaviors that drive long-term success. By applying game theory, founders can build token systems that align user actions with the protocol’s goals, resulting in thriving and sustainable ecosystems.