Asset tokenization is revolutionizing how value is created, traded, and accessed across various industries. By converting physical and intellectual assets into digital tokens on a blockchain, businesses and investors can unlock new liquidity, streamline processes, and lower entry barriers. This transformation is no longer confined to financial assets; it now extends to real estate, intellectual property, environmental assets, and even subscription-based models.

By 2025, the asset tokenization market is expected to be worth $2.08 trillion, with projections showing rapid growth to $13.55 trillion by 2030. Real-world asset (RWA) tokenization has already surpassed $50 billion in on-chain assets, and it’s anticipated to reach $500 billion by the end of 2025. As technology advances and regulations become clearer, tokenization is gaining significant traction with both traditional financial institutions and digital-first enterprises.

What Is Asset Tokenization?

Asset tokenization involves converting the ownership rights of real-world assets into digital tokens on a blockchain. These tokens represent shares of an asset that can be bought, sold, or held, functioning similarly to traditional securities. This method enhances the efficiency of asset management, opens up investment opportunities, and offers stronger security through cryptographic validation.

At its core, asset tokenization bridges the gap between finance and technology, providing a clear route to unlock liquidity and democratize access to high-value assets.

Key Benefits of Asset Tokenization

The significance of asset tokenization lies in its ability to resolve long-standing inefficiencies in global finance. Some of the primary advantages include:

- Improved Liquidity

Tokenization transforms traditionally illiquid assets—such as real estate or collectibles—into tradable digital tokens, greatly enhancing market liquidity. Investors can buy and sell fractional ownership, reducing transaction times and opening up access to previously inaccessible markets. - Broader Accessibility

Tokenization lowers entry barriers, enabling retail investors to participate in high-value asset markets through fractional tokens. This approach broadens the investor base, making wealth-building opportunities accessible across various socioeconomic and geographic groups. - Enhanced Efficiency and Transparency

Blockchain technology eliminates intermediaries and automates processes, cutting costs and reducing delays in asset transfers. Every transaction is securely recorded on the blockchain, ensuring transparency, trust, and operational efficiency across industries. - Fractional Ownership and Portfolio Diversification

Tokenization allows assets to be divided into smaller, tradeable units, enabling investors to diversify their portfolios by owning fractions of various assets. This reduces individual risk while providing more flexibility in asset allocation. - Global Market Access

Digital tokens can be traded globally, removing geographic barriers. Asset owners gain access to a broader pool of investors, while buyers can explore international opportunities, driving liquidity and promoting new business models.

What Types of Assets Can Be Tokenized?

Asset tokenization applies to various asset classes, enabling the digitization of resources, equities, services, and funds. Here are some of the most common types of assets that can be tokenized:

- Natural Resources

Physical assets such as gold, oil, timber, and minerals can be tokenized, allowing for fractional investment and real-time tracking. Tokenized gold, for example, enables global access and enhances liquidity, benefiting producers, investors, and consumers by facilitating digital trade. - Equity

Company shares and private equity can be converted into digital tokens, streamlining fundraising processes and reducing administrative costs. Tokenized equity enables faster settlements, real-time cap table updates, and better access to secondary markets. - Funds

Investment vehicles like mutual funds and ETFs can be tokenized, providing fractional ownership and 24/7 trading. This opens up investment opportunities to a wider base of investors while improving liquidity and simplifying compliance processes. - Services

Professional services such as legal consultations, digital subscriptions, or event access can be tokenized into utility or access tokens. This allows for flexible, secure, and verifiable service delivery, especially in sectors like entertainment and education.

Technologies Powering Asset Tokenization

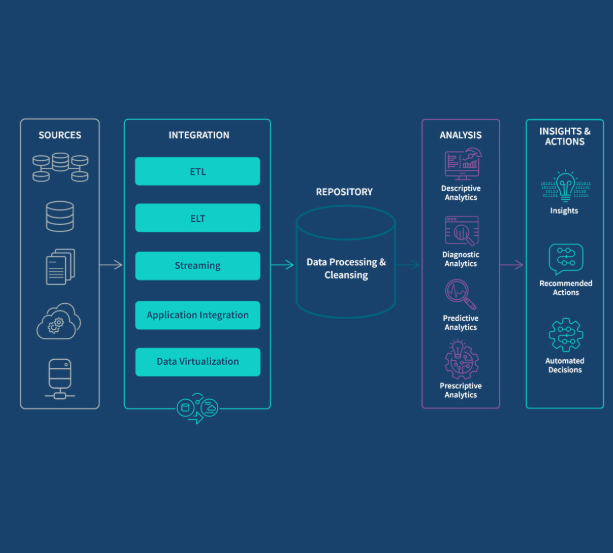

Several emerging technologies are driving the growth of asset tokenization:

- Blockchain and Distributed Ledger Technology (DLT)

Blockchain provides the decentralized infrastructure needed to securely issue, trade, and track tokenized assets. DLT facilitates real-time data sharing, reducing reliance on intermediaries and supporting verifiable records. - Smart Contracts

Smart contracts automate processes such as asset transfers and dividend payouts, ensuring efficiency, reducing costs, and enhancing security. These self-executing contracts make transactions faster and more reliable. - Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML enhance decision-making within tokenized ecosystems by optimizing asset valuations, detecting fraud, and improving risk assessments. These technologies support more resilient and efficient markets.

Emerging Opportunities in Asset Tokenization

Tokenization is opening new market opportunities across various sectors:

- Tokenizing Carbon Credits

Tokenization of carbon credits enables more transparent and traceable investments in sustainability efforts, making it easier to participate in global carbon markets and track environmental impact. - Subscription-Based Tokenization

Recurring services, like streaming or fitness memberships, can be tokenized, allowing users to trade, transfer, or resell subscriptions. This creates new revenue models for providers and increases flexibility for users. - Tokenizing Intellectual Property (IP)

Creators can tokenize their IP—such as books, music, and patents—to represent ownership or licensing rights, improving royalty distribution and empowering creators to retain control over their work. - Investment Fund Tokenization

Tokenizing investment funds allows for instant access to pooled assets like venture capital or real estate, enhancing liquidity and improving transparency. This opens up new global opportunities for investors. - Tokenizing Art and Collectibles

High-value items such as artwork or vintage cars can be tokenized, enabling fractional ownership and greater market liquidity. This shifts the dynamics of how rare and valuable assets are bought and sold.

Sectors Adopting Asset Tokenization

Several industries are quickly adopting tokenization to enhance efficiency and market accessibility:

- Real Estate

Tokenization enables fractional ownership of real estate, making it easier for global investors to participate in property markets without requiring substantial upfront capital. This model improves liquidity and opens up new financing avenues. - Art and Collectibles

Tokenizing artwork and collectibles increases market participation by allowing small investors to own fractions of high-value items. This democratizes access to traditionally exclusive markets. - Intellectual Property

Tokenizing intellectual property rights allows creators to attract global investors, while also streamlining royalty payments and enabling more efficient funding options. - Commodities

Tokenization of commodities like gold and oil creates more transparent markets, improving efficiency and simplifying trade across global networks. - Equities and Stocks

Tokenized stocks enable 24/7 trading and fractional ownership, offering greater flexibility for investors and improving accessibility for both retail and institutional players.

Trends in Asset Tokenization for 2025

Several key trends are shaping the future of asset tokenization:

- Institutional Adoption

Major financial institutions are embracing tokenized assets as regulatory clarity improves. This shift is driving greater confidence and adoption across traditional financial markets. - Integration with Traditional Financial Systems

Legacy financial systems are increasingly integrating blockchain to streamline transactions and reduce costs, creating hybrid models that combine traditional finance with tokenized assets. - Tokenized Real Estate

Real estate tokenization platforms are making it easier for individuals to invest in property, breaking down barriers to entry and offering new funding opportunities for developers. - Demand for Fractional Ownership

The growing demand for affordable ownership in high-value assets is driving the rise of fractional ownership through tokenization. In 2025, micro-investment platforms will likely proliferate. - Regulatory Clarity

As regulatory frameworks for digital assets become more established, businesses will be able to build tokenized ecosystems with greater security and scalability. - Expansion of Tokenized Commodities and Energy Assets

Energy and commodity sectors are adopting tokenization to improve global trading and reduce overhead costs, with tokenized energy credits expected to grow in 2025.

Conclusion

Asset tokenization is reshaping industries by making traditionally illiquid assets more accessible, transparent, and efficient. As this technology continues to evolve, businesses can leverage tokenization to open new revenue streams, enhance liquidity, and democratize investment opportunities. With increasing institutional support and clearer regulations, tokenization is set to play a central role in global finance well into 2025 and beyond.