Web3 startups often face unpredictable market shifts, regulatory hurdles, and changing user expectations. In these volatile conditions, pivoting is not a sign of failure but rather a crucial strategy for survival and growth. This blog will walk you through the key steps for executing a successful pivot—highlighting how to identify challenges, explore new opportunities, and adapt to the evolving Web3 landscape. By examining real-world case studies from successful projects, this guide will provide you with the tools to pivot effectively and thrive in a rapidly changing environment.

Why Web3 Startups Need to Pivot

A. Market Instability

The Web3 market is characterized by unpredictable cycles of growth and decline. For instance, the total value locked (TVL) in DeFi dropped significantly in 2023, from $180 billion to around $37 billion. This contraction exposed the weaknesses of projects reliant on speculative yields. On the other hand, projects that adapted by integrating Real-World Assets (RWAs) or providing institutional DeFi solutions were able to weather the storm.

Example: Maple Finance successfully pivoted from offering undercollateralized loans to building overcollateralized lending pools, while expanding into tokenized private credit markets. This transition allowed Maple to manage over $500 million in institutional assets by 2024, capitalizing on blockchain technology to enhance global credit operations.

B. Regulatory Challenges

The Web3 regulatory environment continues to evolve, with regulations like the EU’s MiCA and the SEC’s scrutiny pushing projects to adjust. The introduction of MiCA created strict licensing requirements in Europe, while the SEC ramped up its enforcement against unregistered securities and non-compliant stablecoins.

Example: In response to regulatory pressures, Circle made significant adjustments to USDC by ensuring it was fully backed by reserves and undergoing monthly audits to maintain transparency and mitigate regulatory risks. Similarly, Binance pivoted away from BUSD after Paxos ceased minting, focusing on compliance-first operations with alternative stablecoins.

Web3 founders need to stay ahead of regulatory changes by engaging with legal experts and continuously auditing their projects to avoid legal complications.

C. User Engagement & Community Decline

Web3 projects with a dwindling user base are at high risk of failure. If user engagement drops significantly, it can signal that a project’s value proposition no longer meets market demands.

Example: Axie Infinity, facing a decline in active users during the play-to-earn crash, successfully pivoted by introducing free-to-play modes and NFT rentals, which revitalized its user base and increased daily active users from around 400,000 in late 2022 to over 1 million by 2024. Similarly, Decentraland increased engagement by launching gamified experiences and partnering with brands like Samsung to create immersive metaverse stores.

The Web3 Pivot Framework

A. Diagnose the Problem

Before making any changes, it’s crucial to recognize the signs that a pivot is necessary. A strategic pivot is based on concrete data rather than emotional responses or market trends. Some key indicators to monitor include:

- Liquidity Issues: A significant and sustained decline in TVL may indicate declining market confidence or the migration of liquidity to other platforms.

- Community Engagement: Low governance participation can be a sign that the community is disengaged, which can weaken the project’s long-term viability.

- Regulatory Risks: Evolving legal frameworks, such as MiCA and SEC regulations, can pose risks that demand preemptive action.

Founders can use platforms like Token Termina to benchmark their projects against competitors and assess their performance using key metrics such as TVL-to-revenue ratios.

B. Identify the Right Pivot Path

Once you’ve identified the need to pivot, it’s essential to choose the right path based on your project’s specific circumstances and long-term goals. Here are three effective pivot strategies:

1. Entering New Markets (Vertical Shift)

Expanding into institutional markets can provide a stable flow of capital, particularly during volatile periods. This pivot is ideal for projects facing declining TVL or liquidity issues.

Example: Aave pivoted from traditional DeFi lending to institutional products like Aave Arc and the GHO stablecoin. Aave Arc caters to institutions with permissioned liquidity pools, while GHO provides a decentralized stablecoin integrated across multiple chains. Aave’s expansion into real-world assets solidifies its position as a leader in institutional DeFi.

2. Upgrading the Technology Stack

Scalability and technical bottlenecks can hinder growth. Transitioning to more advanced blockchain solutions can address these issues, making a significant impact on performance and user experience.

Example: Solana addressed its network congestion problems by introducing the Firedancer validator client. Developed by Jump Crypto, Firedancer can process up to 1 million transactions per second, enhancing network reliability and scalability. This upgrade is expected to attract high-performance decentralized applications (dApps) like Drift Protocol.

3. Revitalizing the Community

A lack of user engagement can severely limit a project’s success. A strategic community reboot can restore momentum and boost user participation.

Example: Curve Finance implemented vote-escrowed CRV (veCRV) tokenomics to encourage long-term staking and governance participation. This initiative significantly increased user engagement and set a new standard for DeFi governance.

C. Execute the Pivot with Precision

Pivoting requires a well-planned, phased approach to minimize disruption. Poorly managed pivots can damage user trust, destroy liquidity, and tarnish a project’s reputation. Here’s how to execute a pivot successfully:

Phase 1: Preparation Before the Pivot

- Engage Your Community: Communication is crucial when pivoting. Start by informing your community through governance proposals, AMAs, and blog updates to ensure transparency and avoid alienating loyal users.

Example: MakerDAO’s pivot to real-world asset collateral involved extensive community discussions and governance votes over several months, ensuring strong support from MKR token holders.

- Simulate Tokenomics Models: Changes in the project’s focus may require recalibrating tokenomics, such as adjusting staking rewards or token emissions. Stress-testing these models ensures they align with the project’s long-term sustainability goals.

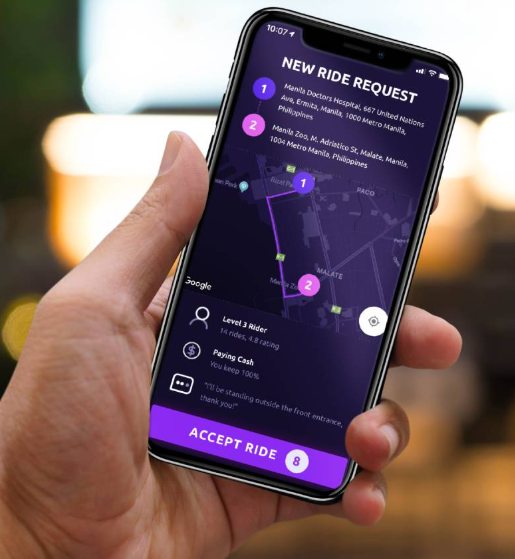

Phase 2: Technical Migration

- Leverage Cross-Chain Bridges: If the pivot involves migrating to a new blockchain or ecosystem, cross-chain bridges are essential for ensuring smooth asset transfers.

Example: Stargate Finance used LayerZero’s omnichain framework to facilitate asset transfers across multiple blockchains, achieving over $2 billion in cross-chain volume.

- Adopt Modular Infrastructure: Upgrading the tech stack is often necessary when pivoting. Modular infrastructure, such as Celestia’s data availability layer, reduces costs and improves scalability for projects expanding to multi-chain environments.

Example: Celestia’s modular architecture enables protocols like EigenLayer to scale efficiently, reducing data availability costs and enhancing performance.

Phase 3: Post-Pivot Growth

- Monitor KPIs: Success after a pivot requires ongoing optimization based on real-time data. Track key metrics such as user retention, governance participation, and liquidity inflows to identify areas for improvement.

Example: Uniswap v3 introduced concentrated liquidity metrics, which allowed liquidity providers to allocate capital more efficiently and optimize fee structures based on user behavior.

- Allocate Contingency Funds: Even well-planned pivots can face unforeseen challenges. Having contingency funds available ensures flexibility in addressing issues like delays or unexpected user attrition.

Example: Solana allocated contingency funds to address challenges during the testing phase of its Firedancer validator client, ensuring smooth upgrades and continued support for high-performance dApps.

Final Thoughts

The most successful Web3 founders are those who can pivot strategically in response to market shifts, regulatory changes, and evolving user needs. Pivoting in Web3 is not a quick fix; it requires careful planning, transparent communication, and a phased approach. By executing a well-managed pivot, founders can align their projects with new opportunities and ensure long-term growth and sustainability.

At TDeFi, we help Web3 startups navigate these complex transitions, offering strategic frameworks and expert insights to guide founders through the pivoting process. With the right tools and guidance, Web3 projects can adapt and thrive in an ever-changing ecosystem.