Token models play a crucial role in the success of blockchain-based projects. They lay the foundation for the project’s economic structure, governance, and incentive systems, directly affecting the long-term viability of the ecosystem. In this guide, we will explore key principles and strategies for creating a sustainable token model, using real-world examples to illustrate effective practices.

What is a Token Model?

A token model refers to the blueprint that outlines how a digital asset functions within a blockchain ecosystem. It includes the creation, distribution, and usage of tokens, and is fundamental in shaping the project’s economic incentives and governance mechanisms. A well-designed token model not only encourages user participation but also ensures fair value distribution, which is essential for long-term success.

A great example of a successful token model can be seen in decentralized finance (DeFi) platforms. Projects such as Aave and Compound have thrived by creating tokenomics that incentivize users and ensure liquidity.

Different Types of Tokens

Tokens can be categorized into three main types: utility tokens, security tokens, and governance tokens.

- Utility Tokens: These tokens are used to access specific services within an ecosystem. For example, the LINK token in the Chainlink network is used to pay for data, facilitating smart contracts with reliable external information.

- Security Tokens: Security tokens represent ownership in an asset, company, or project and are typically subject to regulatory oversight. The INX token, for example, was issued through a regulated IPO, offering a compliant entry point for investors into the blockchain sector.

- Governance Tokens: These tokens grant holders voting rights within a decentralized protocol. Uniswap’s UNI token, for example, allows token holders to influence decisions regarding the future of the Uniswap protocol.

Key Principles for Creating a Sustainable Token Model

To ensure a token’s long-term sustainability, several core principles must be considered:

Utility and Value Creation

For a token to remain sustainable, it must serve a meaningful purpose within the ecosystem. The demand for the token should be driven by its utility, not just speculation. Tokens that fulfill a clear function are more likely to retain their value.

Example: Polygon (MATIC) – MATIC is used to pay transaction fees and participate in the proof-of-stake consensus within the Polygon network. Its utility, combined with the widespread use of decentralized applications (dApps), ensures constant demand for the token.

Scarcity and Inflation Control

The total supply of tokens must be carefully managed to prevent inflation, which can devalue the token. Implementing mechanisms like fixed supply caps, token burns, or deflationary tactics can help maintain its value over time.

Example: Binance Coin (BNB) – Binance regularly burns a portion of its BNB supply, which helps reduce the circulating tokens, maintaining the coin’s value even as its utility within the Binance ecosystem grows.

Governance and Community Participation

A token model must involve the community in decision-making processes. Allowing users to govern the network ensures that the system evolves in a way that reflects their needs and interests.

Example: Aave (AAVE) – The AAVE governance token allows users to vote on protocol upgrades and other key decisions. This decentralized governance model has helped Aave stay relevant and adapt in the fast-evolving DeFi space.

Designing the Token Economy

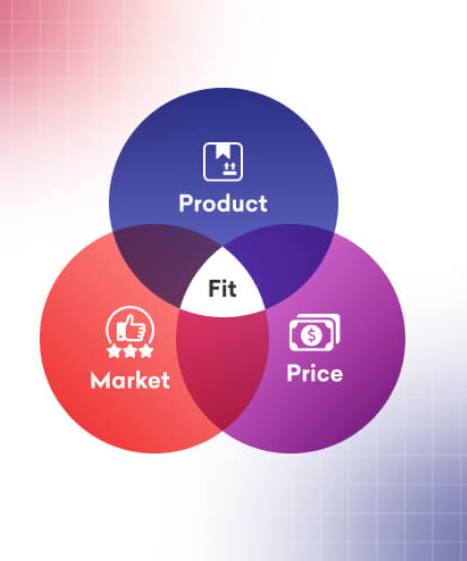

Defining the Token’s Purpose

The first step in designing a token economy is to define the token’s purpose clearly. Whether it’s for transactions, governance, or access to services, the token should have a clear role that aligns with the project’s objectives and user needs.

Example: Filecoin (FIL) – FIL tokens are essential for Filecoin’s decentralized storage network, used for paying for data storage and retrieval services. The token’s clear utility helps maintain demand within the network.

Token Supply and Distribution Strategy

A well-crafted supply and distribution strategy is vital for the token’s sustainability. This includes determining the initial token supply, establishing vesting schedules for team members and early investors, and planning for future token issuance.

Example: Solana – Solana’s token distribution was structured with a careful vesting schedule, which ensured that tokens were gradually released to avoid sudden sell-offs that could destabilize the token’s value.

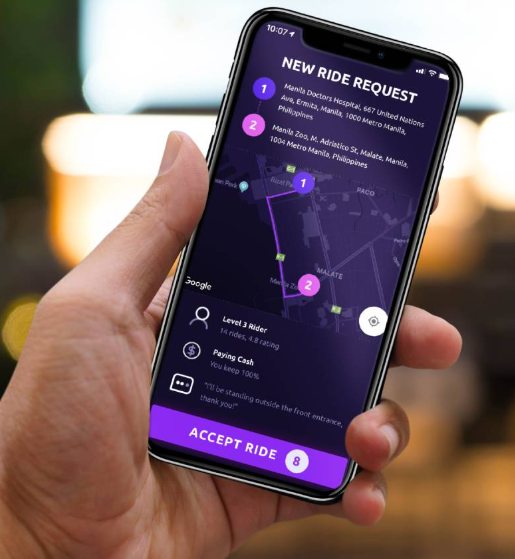

Incentives and Rewards Mechanisms

Incentives drive user participation and should be structured to encourage long-term engagement rather than short-term speculation. Staking rewards, liquidity mining, and fee discounts are common examples of incentive models.

Example: Synthetix (SNX) – SNX token holders can stake their tokens to mint synthetic assets and earn rewards. This system encourages users to hold onto their tokens, contributing to the platform’s growth and stability.

Ensuring Long-Term Sustainability

Economic Sustainability

For a project to be economically sustainable, it must generate sufficient revenue to cover operational costs. This could be through transaction fees, subscription models, or other value-added services.

Example: Ethereum 2.0 – Ethereum’s transition to a proof-of-stake model aims to reduce energy consumption and inflation while still providing rewards to stakers, ensuring long-term economic sustainability.

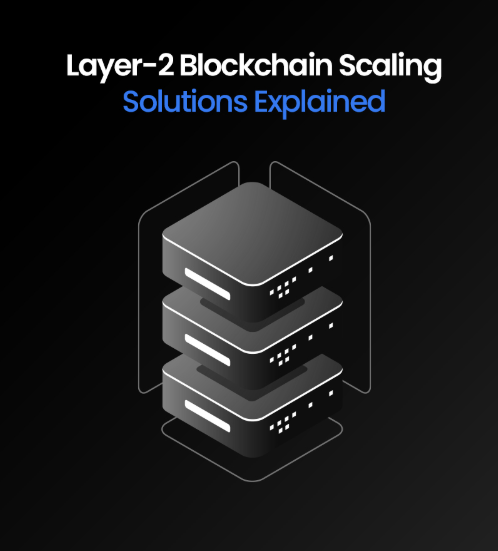

Technological Sustainability

Technological sustainability ensures that the blockchain technology behind the token model remains scalable, secure, and adaptable to changes. Regular upgrades and strong security practices are necessary to keep the network robust.

Example: Polkadot – Polkadot focuses on interoperability, allowing different blockchains to communicate and share security. This design ensures that the platform can evolve alongside the needs of the blockchain ecosystem.

Legal and Regulatory Compliance

It’s essential to design a token model that complies with legal regulations. Adhering to securities laws, anti-money laundering (AML) rules, and Know Your Customer (KYC) requirements ensures the project’s legitimacy.

Example: INX Limited – INX conducted the first SEC-registered token IPO, demonstrating that it’s possible to innovate within the blockchain space while adhering to legal and regulatory frameworks.

Common Mistakes and How to Avoid Them

Speculation Overload

Relying too heavily on speculative value can lead to market volatility and long-term instability. A sustainable token model should create intrinsic value through real utility rather than speculative hype.

Example: Dogecoin – While Dogecoin has experienced price surges due to speculation, its lack of real-world utility has led to long-term instability.

Poorly Structured Incentives

Incentives that offer unsustainable rewards can lead to inflation and devalue the token. Carefully crafted incentives should promote long-term participation and growth.

Example: DeFi Projects in 2020 – Many DeFi platforms that offered high liquidity mining rewards faced inflationary pressures, leading to the devaluation of governance tokens.

Ignoring Regulatory Risks

Not considering the regulatory landscape can lead to legal challenges, such as fines or project shutdowns. It’s crucial to design the token model with regulatory compliance in mind.

Example: Ripple’s XRP – Ripple faced a legal battle with the SEC, which claimed XRP was an unregistered security, resulting in regulatory uncertainty and a negative impact on the token’s adoption.

Conclusion: Creating a Token Model for the Future

A sustainable token model requires a deep understanding of the project’s economic, technological, and regulatory aspects. By focusing on real utility, managing token supply, encouraging long-term engagement, and ensuring compliance, projects can build token models that not only survive but thrive.

Successful token models like Ethereum, Binance Coin, and Uniswap have been built on clear utility, well-planned economic strategies, and strong community governance. As the blockchain industry continues to evolve, sustainable token models will be crucial for driving innovation and achieving lasting success.