In recent years, blockchain has emerged as a game-changing technology, reshaping industries across the globe. The oil and gas sector, facing pressures to improve transparency, cut costs, and meet environmental regulations, has begun embracing blockchain to streamline operations and improve data management. With projections suggesting the blockchain market in this industry could grow from $1.1 billion in 2024 to $23.5 billion by 2034, the technology’s potential to revolutionize this space is undeniable.

The rise of blockchain in oil and gas is a response to longstanding inefficiencies, such as disputes in trade settlements and delays in transaction processing. Blockchain’s ability to automate processes, reduce human error, and increase data security has the power to enhance business practices, enabling organizations to stay ahead in an increasingly competitive and regulated environment.

Blockchain’s Growing Role in Oil and Gas Operations

While blockchain initially gained traction in the financial industry, its principles of decentralization, transparency, and immutability make it an ideal fit for oil and gas. Whether it’s managing assets in the upstream sector or overseeing distribution in the downstream segment, blockchain addresses critical challenges like data integrity, compliance, and operational security.

As the industry modernizes, blockchain’s role is becoming central in ensuring secure transactions and data protection across the supply chain. Its adoption is helping streamline operations, lower risks, and improve the accountability of all involved stakeholders.

Benefits of Blockchain in Oil and Gas

Blockchain technology has the potential to enhance various aspects of the oil and gas industry, providing several key advantages:

- Asset Management Efficiency

With vast assets spread across remote locations, tracking oilfield equipment, pipelines, and other critical infrastructure can be a logistical challenge. Blockchain facilitates real-time asset tracking, ensuring each piece of equipment is properly maintained and secure, thus reducing downtime and improving safety. - Enhanced Transaction Efficiency with Smart Contracts

Blockchain’s smart contracts automate agreement execution. For instance, payments can be triggered automatically once oil deliveries are confirmed, eliminating the need for manual intervention and minimizing delays in financial settlements. - Building Trust Across Stakeholders

Oil and gas operations often involve multiple parties, including operators, logistics firms, and government agencies. Blockchain ensures that all stakeholders can access the same ledger, reducing fraud risks and miscommunication, and enhancing trust throughout the value chain. - Improved Land and Ownership Record Management

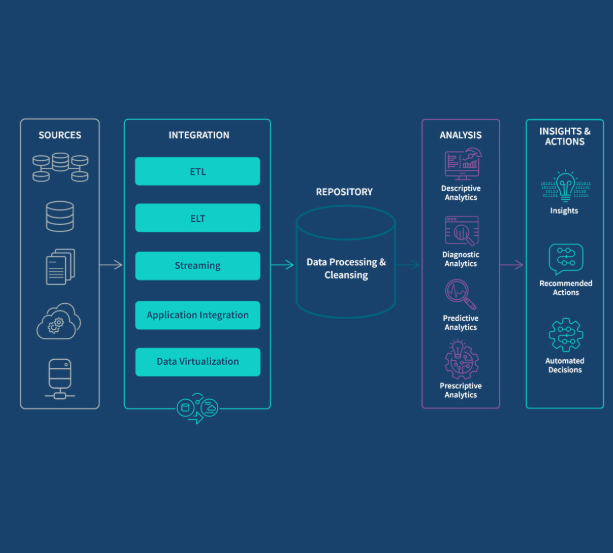

Blockchain provides an immutable record for land titles and lease agreements, reducing ownership disputes and facilitating smoother property transactions. This helps operators gain clarity on property rights, accelerating project timelines. - Robust Data Storage

Storing sensitive operational data on blockchain ensures it remains tamper-proof. Geological surveys, drilling reports, and maintenance logs are safely stored, mitigating cybersecurity risks and ensuring the integrity of essential records. - Improved Transparency and Accountability

Blockchain facilitates real-time tracking of field data, such as drilling activities and emissions monitoring. This allows for more transparent Environmental, Social, and Governance (ESG) reporting, improving corporate governance and investor trust. - Streamlined Supply Chain Management

Blockchain ensures that each component, from drill bits to machinery parts, is traceable throughout the supply chain. This reduces counterfeiting, ensures timely delivery, and supports just-in-time models for logistics. - Improved Compliance and Regulatory Monitoring

Blockchain creates a transparent audit trail for regulatory compliance activities. Auditors and regulators can access accurate, up-to-date data instantly, helping to meet safety and environmental standards with minimal administrative effort.

Practical Blockchain Applications in Oil and Gas

Blockchain’s practical use cases are expanding, and the technology is making significant strides in real-world applications across the oil and gas sector. Here are some prominent examples:

- Streamlined Commodity Trading

Blockchain simplifies the trading process by offering a transparent, tamper-proof ledger. It minimizes errors, accelerates transaction timelines, and facilitates more secure international trades. - Contract Automation

Smart contracts automate key processes such as payment settlements and service agreements, ensuring faster execution and minimizing disputes. These contracts are particularly effective in joint ventures and service agreements. - Sensor-Enabled Billing

IoT sensors integrated with blockchain technology enable real-time invoicing based on operational data. This automation reduces human errors and accelerates the billing cycle. - Digitalizing Crude Oil Transactions

Blockchain enhances visibility throughout the crude oil supply chain, from production to payment, reducing fraud risks and ensuring smoother financial settlements. - Compliance Tracking

Blockchain creates immutable records of compliance-related activities such as safety inspections and regulatory filings. This facilitates immediate access for auditors and regulators, improving oversight. - Tracking Hydrocarbon Movement

Blockchain allows for the tracking of hydrocarbons from extraction to final use. This ensures transparency, supports sustainability efforts, and helps differentiate environmentally friendly products. - Land Ownership and Title Management

Blockchain offers a transparent and secure platform for managing land ownership, lease, and mineral rights, reducing disputes and streamlining the transfer process. - Financial Reconciliation

Blockchain enhances the reconciliation of financial transactions by storing them in a distributed ledger. This improves audit visibility and enables real-time tracking of payments and revenues.

Challenges in Blockchain Adoption

Despite its potential, integrating blockchain technology into oil and gas operations presents a range of challenges:

- Compatibility with Legacy Systems

Oil and gas companies often rely on outdated systems that are not compatible with blockchain frameworks. Integrating blockchain with legacy infrastructure requires significant custom development, slowing adoption. - High Initial Investment

The upfront cost of implementing blockchain can be prohibitive, especially for smaller firms or joint ventures. It requires investment in technology, skilled personnel, and stakeholder alignment. - Scaling Beyond Pilot Programs

While blockchain solutions show promise in pilot projects, scaling them across the entire supply chain presents challenges in terms of data standardization, interoperability, and achieving broad industry participation. - Navigating Legal Complexities

Blockchain’s decentralized nature can conflict with jurisdictional regulations on data sovereignty and digital signatures, complicating compliance. - Cybersecurity Risks

While blockchain enhances data integrity, vulnerabilities still exist. Cybersecurity threats targeting endpoints and smart contracts require robust measures to safeguard sensitive data. - Blockchain Talent Shortage

The oil and gas industry faces challenges in recruiting professionals with the required blockchain expertise. A multidisciplinary approach is essential for successful implementation. - Resistance to Change

Organizational resistance to adopting new technologies can slow blockchain adoption. Overcoming cultural inertia and fear of job displacement requires strong leadership and comprehensive training.

Real-World Examples of Blockchain in Oil and Gas

Several major players in the oil and gas industry have already successfully implemented blockchain technology. For instance:

- VAKT: This blockchain platform has digitized post-trade processes, reducing settlement times and increasing accuracy in the North Sea crude oil market.

- Abu Dhabi National Oil Company (ADNOC): ADNOC has partnered with IBM to track oil production in real-time, enhancing transparency and sustainability efforts.

- Repsol: By using blockchain for internal safety certification management, Repsol reduced error rates by 40%, improving compliance and audit readiness.

- Petrobras: Petrobras has adopted blockchain for offshore equipment tracking, optimizing maintenance records and logistics.

- Equinor and Data Gumbo: Through blockchain-based smart contracts, Equinor has automated payment processes in drilling operations, improving payment efficiency and eliminating disputes.

- Chevron: In collaboration with ConsenSys, Chevron has developed a blockchain solution for managing joint venture accounting, minimizing reconciliation issues and improving financial visibility.

Looking Ahead: The Future of Blockchain in Oil and Gas

The future of blockchain in oil and gas looks promising, with potential benefits spanning the entire value chain:

- Revolutionizing Trade

Blockchain could transform oil and gas trading by enabling transparent, real-time transactions and eliminating intermediaries. - Streamlining Operations

Blockchain can automate workflows, improving coordination across upstream, midstream, and downstream sectors, reducing downtime and inefficiencies. - Enhanced Security and Regulatory Compliance

The technology’s immutability ensures secure data storage, while improving compliance by enabling transparent and verifiable audit trails. - End-to-End Supply Chain Visibility

Blockchain’s ability to track every step of the supply chain offers greater accountability and reduces procurement fraud. - Promoting Sustainability

Blockchain can support sustainability by tracking carbon emissions and facilitating tokenized carbon credits for more transparent green practices. - Empowering Collaboration

Blockchain can enhance collaboration across partnerships and joint ventures, creating a single source of truth and improving trust without third-party intermediaries. - Simplified Regulatory Compliance

By storing all compliance-related data on a decentralized ledger, blockchain simplifies audit processes and ensures timely reporting.

Conclusion

Blockchain is no longer just a futuristic concept for the oil and gas industry; it is quickly becoming a vital tool in modernizing operations. From automating trade settlements to enhancing transparency and boosting compliance, blockchain technology is reshaping the sector. While challenges remain, including system integration and security concerns, the future of blockchain in oil and gas looks bright. Companies that embrace this technology early will likely lead the charge in transforming the industry into a more efficient, transparent, and sustainable one.