The world of Decentralized Finance (DeFi) lending has made significant strides, offering decentralized alternatives to traditional financial systems. These platforms have unlocked new possibilities for borrowing, lending, and earning interest on digital assets, all without relying on intermediaries like banks. By early 2025, the total value locked (TVL) in DeFi protocols has surpassed $128.6 billion, a clear indicator of the growing influence of decentralized lending.

Major platforms like Aave have seen impressive growth, reaching a TVL of $23.5 billion, while others such as Compound continue to play pivotal roles in this space. As more retail and institutional players enter, DeFi lending is being recognized for its transparency, efficiency, and reduced operational costs, thanks to the smart contracts that drive these platforms.

In this article, we’ll explore the workings of DeFi lending, its advantages over traditional systems, and the top DeFi lending platforms of 2025.

What is DeFi Lending?

DeFi lending refers to blockchain-based platforms that enable users to lend or borrow cryptocurrencies without using traditional financial intermediaries. These platforms use smart contracts to automate lending terms, manage collateral, and facilitate interest payments. Unlike traditional financial systems, DeFi lending allows anyone with a digital wallet to participate, removing geographic and institutional barriers and fostering a more inclusive financial ecosystem.

Key Features of DeFi Lending

- Security

DeFi lending platforms rely on open-source smart contracts that undergo rigorous audits to minimize vulnerabilities. Many protocols integrate third-party verification and real-time monitoring tools for added security. Despite these efforts, users must still research the credibility of audit firms and platform histories before committing their assets. - Liquidity

Liquidity is crucial for the smooth operation of DeFi lending platforms. Liquidity pools, built from user deposits, allow for efficient asset borrowing and withdrawal. Top platforms like Aave and Compound incentivize liquidity provision through yield farming, ensuring a steady flow of assets for borrowers. - User Experience

DeFi lending platforms have greatly improved their user interfaces, with mobile-friendly dashboards, real-time data, and educational resources for beginners. Wallet integrations have also become easier, making it simple for users to connect and interact with platforms.

Criteria for Choosing the Best DeFi Lending Platforms

- Security and Audits

Thorough security audits and bug bounty programs are essential for top platforms. Reliable platforms provide transparent audit reports and continuously monitor and patch vulnerabilities. - Interest Rates and APY

Competitive and transparent interest rates are a hallmark of quality DeFi platforms. Look for platforms that adjust rates dynamically, based on market conditions, to maximize returns and provide flexible borrowing options. - Asset Diversity

Platforms supporting a wide range of assets, from stablecoins to cross-chain tokens, provide more options for users and reduce risks tied to concentrated assets. - User Interface and Experience

A simple and well-organized interface that offers easy access to real-time data, such as APYs, loan status, and transaction history, is essential for platform adoption. - Liquidity and Volume

High liquidity and trading volume are crucial for minimizing slippage and ensuring efficient transactions. Platforms with strong liquidity metrics ensure quicker order execution and lower borrowing costs. - Collateralization Options

DeFi lending platforms are beginning to explore undercollateralized lending, using credit scoring models or reputation-based systems, although overcollateralization remains the norm. - Governance

Decentralized governance, typically via DAOs, enables the community to participate in decision-making processes and helps ensure long-term platform sustainability. - Advanced Financial Tools

Platforms that integrate advanced financial tools like derivatives and synthetic assets give users more options for generating yield and hedging risk.

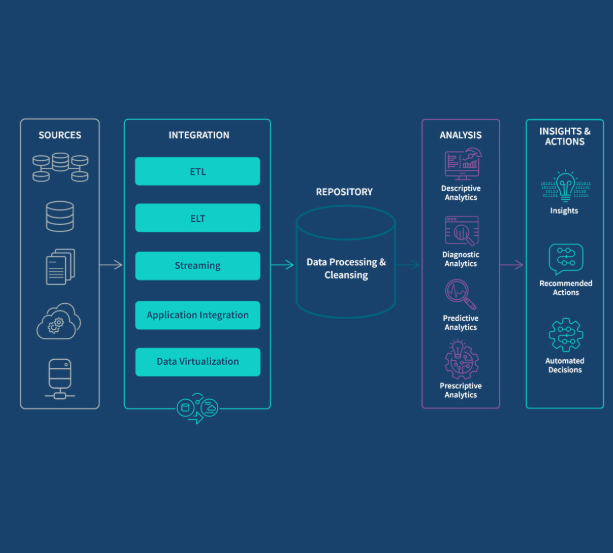

How Does DeFi Lending Work?

- Lending Pools

Users deposit assets into decentralized pools, which are then available for borrowers to access. Platforms like Aave and MakerDAO manage these pools and automatically match borrowers with lenders using smart contracts. - Interest Rates

Interest rates on DeFi platforms fluctuate based on supply and demand within the lending pool. High demand for loans drives up rates for borrowers, while lenders earn higher yields. - Borrowing Process

To borrow, users must deposit collateral—often more than the loan value—into a smart contract. If the collateral value drops too much, the smart contract automatically liquidates it to protect lenders. - Smart Contracts

Smart contracts manage all aspects of DeFi lending, including collateral management, loan disbursement, and repayment tracking, removing the need for intermediaries and reducing operational costs. - Yield Farming

Yield farming involves moving assets across various platforms to optimize returns. Some platforms incentivize liquidity providers with governance tokens, allowing users to earn additional rewards while they lend.

Differences Between Traditional Lending and DeFi Lending

- Access

Traditional lending requires identity verification, credit checks, and often geographic eligibility, whereas DeFi lending is open to anyone with a crypto wallet. This opens up opportunities for global participation, regardless of socio-economic status. - Intermediaries

Traditional systems rely on banks and credit institutions to manage loans, often introducing delays and fees. DeFi eliminates intermediaries, using smart contracts for faster, more cost-efficient operations. - Collateralization

DeFi uses overcollateralization—where borrowers must lock in more value than they borrow—while traditional finance may not always require collateral. This is due to the absence of credit checks in DeFi, with smart contracts managing risk. - Transparency

DeFi platforms provide full transparency through blockchain, where users can audit every transaction in real-time. Traditional systems, on the other hand, operate in closed environments, limiting visibility into financial data. - Operating Hours

While banks have set operating hours and require days for settlement, DeFi platforms are available 24/7, enabling instant or near-instant settlement through smart contracts.

Top 10 DeFi Lending Platforms in 2025

- Aave

Aave offers both variable and stable interest rates, as well as innovative features like flash loans and collateral swapping. Its v4 upgrade enhances cross-chain liquidity and offers modular governance. - Compound

Compound allows users to earn interest or borrow crypto, with algorithmic interest rate adjustments based on supply and demand. Its governance token, COMP, gives the community control over platform decisions. - MakerDAO

MakerDAO supports the DAI stablecoin ecosystem with an overcollateralized lending model, offering stability and long-term decentralized loans without the need for asset liquidation. - Uniswap

Uniswap, known for its decentralized exchange, now includes lending capabilities through UniswapX, enabling lending, flash loan bundling, and liquidity routing across protocols. - Balancer

Balancer enables customizable liquidity pools, allowing users to earn yield by providing liquidity to smart pools. Its veBAL model enhances long-term governance and incentives. - SushiSwap

SushiSwap’s Kashi feature allows users to create isolated lending pairs, reducing systemic risk. SushiX enables cross-chain collateral movement, further enhancing capital efficiency. - Curve Finance

Curve specializes in stablecoin liquidity, offering low-slippage swaps and lending opportunities. Its lending mechanism ensures soft liquidation to protect users’ assets. - Yearn Finance

Yearn automates yield farming through Vaults, aggregating returns from multiple platforms. It provides passive income strategies while minimizing fees and optimizing risk-adjusted returns. - Synthetix

Synthetix allows users to mint synthetic assets, enabling exposure to a wide range of assets without direct ownership. It integrates with derivatives and liquidity provisioning for advanced users. - Lido

Lido provides liquid staking solutions for Ethereum and other PoS chains, allowing staked assets to be used as collateral for lending. Its deep integration into the Ethereum ecosystem makes it a valuable player in DeFi lending.

DeFi Lending Trends for 2025

- AI Integration

AI will be used to improve credit risk assessments, fraud detection, and protocol governance, making DeFi platforms more efficient and secure. - Interoperability

Cross-chain bridges and Layer 2 solutions will improve the flow of assets across networks, enabling better liquidity and user experience. - Enhanced Security

Continuous monitoring and formal verification of smart contracts will improve platform security and restore user confidence. - Regulatory Compliance

DeFi platforms will adapt to regulatory requirements, ensuring compliance while maintaining decentralization principles. - Integration with Traditional Finance

The convergence of DeFi and traditional finance will continue, with tokenized real-world assets and compliant stablecoin solutions paving the way for institutional adoption.

Conclusion

DeFi lending has matured into a mainstream financial service, offering users instant access to liquidity, competitive returns, and more control over their assets. As the space continues to evolve, platforms like Aave, Compound, and MakerDAO will lead the charge in transforming the global financial landscape. By understanding the top platforms and trends, users can confidently participate in the growing DeFi ecosystem.