Modern fraudsters have become increasingly sophisticated, forcing organizations to rethink their defensive strategies. Traditional rule-based detection systems simply can’t keep pace with today’s complex scams. That’s where artificial intelligence steps in, offering dynamic protection that evolves alongside emerging threats.

The Growing Necessity for AI in Fraud Prevention

Financial institutions and businesses lose billions annually to fraudulent activities, with scams growing more elaborate each year. Conventional fraud detection methods, which rely on static rules and manual reviews, often fail to catch these advanced schemes until it’s too late. AI-powered solutions provide the speed, accuracy, and adaptability needed to counter modern fraud tactics effectively.

These intelligent systems don’t just react to known threats—they anticipate new ones by analyzing patterns and behaviors across vast datasets. This proactive approach helps organizations stay ahead of criminals while minimizing false positives that inconvenience legitimate customers.

How AI Transforms Fraud Detection

- Real-Time Pattern Recognition

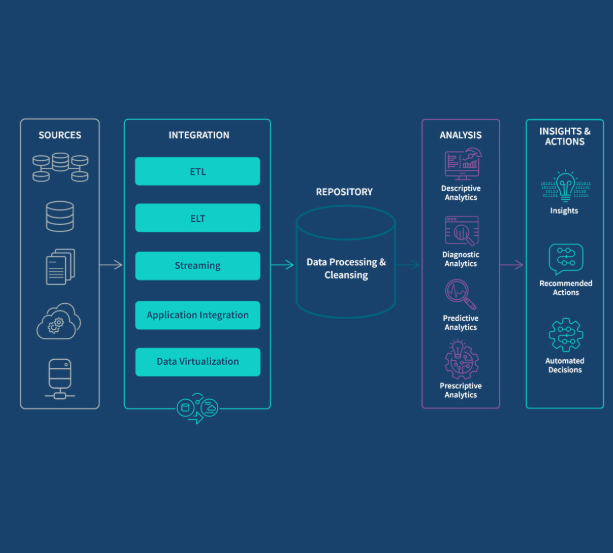

AI models continuously monitor transactions, user behaviors, and system activities, identifying anomalies that signal potential fraud. Unlike traditional systems, they can detect subtle deviations from normal patterns that might indicate emerging threats. - Self-Learning Algorithms

Machine learning enables these systems to refine their detection capabilities over time. The more data they process, the better they become at distinguishing between legitimate and fraudulent activities. - Cross-Channel Analysis

By integrating data from multiple sources—transactions, logins, customer support interactions—AI provides a comprehensive view of potential risks rather than analyzing activities in isolation. - Predictive Threat Assessment

Advanced AI models can forecast potential fraud vectors by identifying suspicious trends before they escalate into full-blown attacks.

Key Applications Across Industries

- Financial Services

Banks and payment processors use AI to detect unauthorized transactions, account takeovers, and money laundering attempts with greater precision than static rules allow. - E-Commerce

AI helps retailers identify fake accounts, fraudulent purchases, and return scams while minimizing false declines that frustrate legitimate customers. - Insurance

Machine learning models analyze claims for potential fraud by comparing them against historical patterns and known fraudulent behaviors. - Telecommunications

Mobile carriers deploy AI to detect SIM swap fraud, subscription scams, and unauthorized premium service activations.

The Future of Fraud Prevention

As fraud techniques grow more advanced, AI systems are evolving to counter them through:

- Behavioral biometrics that analyze user interaction patterns

- Federated learning that improves detection without compromising data privacy

- Explainable AI that provides transparent reasoning behind fraud alerts

Businesses that adopt these AI-powered solutions gain not just stronger fraud protection but also improved operational efficiency and customer satisfaction. By reducing false positives and automating manual review processes, companies can allocate resources more effectively while providing smoother experiences for legitimate users.

The fight against fraud isn’t static—it’s an ongoing arms race. Organizations that leverage AI’s adaptive capabilities position themselves to stay ahead of threats rather than playing catch-up. As these technologies continue advancing, they’ll become even more essential for businesses looking to protect their assets and maintain customer trust in an increasingly digital world.