Artificial intelligence (AI) is increasingly transforming various industries, and the insurance sector is no exception. AI’s impact on claims processing is particularly profound, offering innovative solutions to the industry’s long-standing challenges. By automating key tasks and improving decision-making, AI is helping insurers enhance efficiency, reduce operational costs, and improve customer satisfaction. In fact, studies have shown that AI-driven automation can reduce claims processing costs by up to 30%, while also enhancing accuracy and increasing customer satisfaction.

This blog delves into how AI is reshaping the insurance claims process, the benefits of adopting AI, and what the future holds for AI-driven claims management.

A Look at Traditional Insurance Claims Processing

Managing insurance claims has traditionally been a complex and manual process, requiring significant human intervention for data entry, document analysis, and decision-making. Many insurers still rely on outdated systems and paper-based workflows, resulting in inefficiencies and higher costs. These processes often lead to delays, errors, and customer frustration.

Additionally, the insurance industry faces challenges such as fraud detection and risk assessment, all while trying to meet rising customer demands for faster claim resolutions. These challenges underline the urgent need for digital transformation in the industry. Enter AI-driven claims processing, which offers a solution to these inefficiencies, allowing insurers to streamline operations and offer quicker, more accurate services.

How AI is Transforming Insurance Claims Processing

AI is revolutionizing the insurance claims process by automating routine tasks, enhancing decision-making, and improving customer service. Here’s how AI is making a difference:

1. Automating Routine and Repetitive Tasks

One of the key benefits of AI in claims processing is its ability to automate repetitive tasks. Machine learning (ML) algorithms can process large volumes of structured and unstructured data, such as policy documents, medical reports, and police statements, reducing the need for manual document review and data entry.

For example, digital-first insurer Lemonade has demonstrated the power of AI by settling claims in just 3 seconds with its AI-powered bot, Jim. This shows just how quickly AI can accelerate the claims process.

2. Streamlining the Claims Management Process

AI can automate entire claims workflows, making it easier for insurers to handle the process from start to finish. Intelligent systems can quickly route claims to the appropriate departments and process simple claims automatically. This not only accelerates the process but also improves the overall efficiency of claims management.

For instance, Ping An Insurance uses AI for real-time auto damage claim processing, leveraging image recognition to cut settlement times by 70%, resulting in higher customer satisfaction.

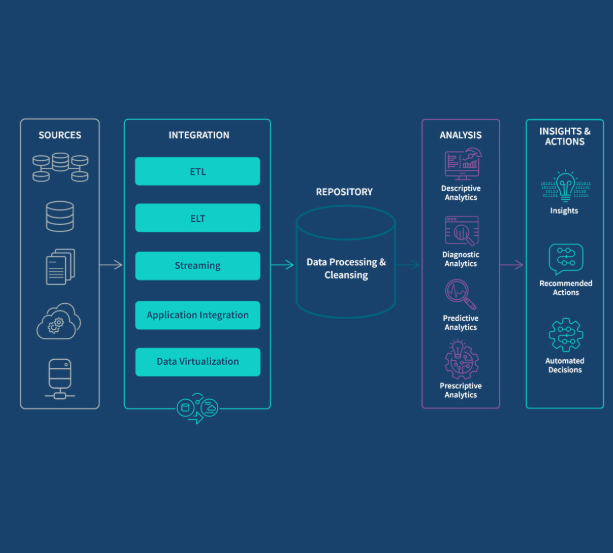

3. Enabling Smarter Decision-Making with Predictive Analytics

AI does more than just automate tasks; it enhances decision-making through predictive analytics. AI models can assess claim severity, predict costs, and identify high-risk claims more accurately than traditional methods. Predictive analytics helps insurers make more informed decisions, improving the accuracy of claim assessments and cost forecasting.

Swiss Re, for example, uses machine learning for health and accident claim forecasting, resulting in more accurate underwriting and a 20% reduction in losses compared to previous methods.

4. Improving Fraud Detection

Fraud prevention is a critical challenge in the insurance industry, and AI is playing a crucial role in addressing this. By analyzing vast amounts of data and detecting unusual patterns, AI can flag potential fraudulent claims. For example, Aviva used AI-powered claims processing automation to detect 12,000 fraudulent claims, amounting to £113 million in value.

5. Enhancing Customer Experience

AI-powered tools such as chatbots and virtual assistants help improve the customer experience by providing instant support during the claims process. These AI-driven assistants can guide customers through the claims filing process, answer questions, and resolve issues, all while offering round-the-clock assistance.

A PwC report found that 74% of insurance customers are comfortable using AI tools, with many preferring digital channels for their convenience.

6. Faster and More Personalized Communication

AI allows insurers to provide real-time updates to policyholders, personalizing communication based on past interactions. This improves the customer experience by keeping clients informed and engaged throughout the claims process.

For example, Progressive Insurance implemented AI-powered chatbots, resulting in a 25% increase in customer satisfaction due to better personalized communication.

Benefits of AI in Claims Processing

The integration of AI in claims processing offers multiple advantages for both insurance companies and their customers. Here are some of the key benefits:

1. Faster Claims Processing

Traditional claims processing involves a lot of manual work, which can delay the entire process. AI speeds up this process by quickly analyzing large amounts of data, allowing insurers to resolve claims faster. This not only reduces costs but also enhances customer satisfaction by providing quicker resolutions.

2. Advanced Fraud Detection

AI excels at identifying fraudulent claims by analyzing patterns and detecting anomalies in data. With AI, insurers can proactively address fraud, improving the integrity of the claims process.

3. Smarter Prioritization of Claims

AI technology can automatically evaluate claims based on their complexity and urgency. This helps insurers prioritize high-priority cases, ensuring that they are handled by the right personnel swiftly. This improved prioritization enhances both efficiency and customer satisfaction.

4. Ensuring Regulatory Compliance

AI systems can monitor claims processing for compliance with industry regulations. Automated alerts notify insurers when regulatory violations are detected, reducing the risk of legal issues and ensuring compliance with industry standards.

5. Stronger Collaboration Across Teams

AI-driven tools provide real-time analytics that improve communication and collaboration across departments. This helps teams work together more effectively, even in remote or decentralized environments, leading to better operational decision-making.

6. Efficient Claims Validation

AI models can automatically validate claims by cross-referencing submitted information with policy details and historical data. This reduces human error, improves accuracy, and ensures compliance with policy terms, ultimately enhancing the credibility of the claims process.

7. Improved Reporting

AI tools can analyze complex data sets to produce detailed, accurate reports, which are essential for internal audits, compliance checks, and decision-making. AI-driven insights help identify trends and patterns that can guide strategic planning and resource allocation.

The Future of AI in Claims Processing

AI is not just improving claims processing today; it is paving the way for even more advanced developments in the future. Here’s a look at some of the trends that will shape the future of AI in the insurance industry:

1. Real-Time Claims Processing with IoT and AI

The integration of Internet of Things (IoT) devices with AI will enable real-time claims processing. For example, health insurers could use data from wearable devices to detect medical events like heart attacks, automatically validate the claim, and provide instant emergency assistance.

2. Virtual Reality (VR) and Augmented Reality (AR) for Remote Claims Assessment

AI-powered VR and AR technologies could allow claims adjusters to conduct remote inspections of damaged property. For instance, in commercial property insurance, adjusters could use VR headsets to assess damage, while AI analyzes the data for accurate damage reports.

3. Emotion AI for Customer Support

AI systems equipped with emotion recognition technology will enable insurers to provide more empathetic customer support. For example, life insurance claims could trigger AI systems to detect emotional distress in callers and escalate the issue to a human agent if needed.

4. Deep Learning for Smarter Fraud Detection

AI systems using deep learning models can analyze complex patterns in travel insurance claims, such as detecting inconsistencies in booking data or suspicious patterns of claim submissions, helping insurers identify fraudulent activities more effectively.

5. Voice-Activated AI Assistants for Claims Handling

Voice-activated AI assistants will further enhance the claims experience by allowing policyholders to file claims and communicate their symptoms verbally, making the process quicker and more convenient.

6. AI + Blockchain for Transparent and Efficient Processing

The combination of AI and blockchain could revolutionize the claims process by ensuring transparency and efficiency. Blockchain’s secure, immutable ledger would work alongside AI to track claims data, reducing fraud and speeding up settlements.

7. Self-Learning AI for Continuous Optimization

Self-learning AI systems can adapt to local market conditions and customer preferences, continuously improving the claims process. This allows insurers to stay responsive to emerging challenges, such as cybercrime or extreme weather events.

Final Thoughts

The adoption of AI in insurance claims processing is transforming the industry by reducing costs, improving efficiency, and enhancing customer satisfaction. As AI continues to evolve, its role in claims management will only grow, providing insurers with more advanced tools to streamline operations and meet the demands of modern customers.

However, it’s important to recognize that while AI significantly boosts operational efficiency, human oversight remains essential for handling complex or sensitive claims. By leveraging AI responsibly, insurers can improve their processes while maintaining the personal touch that is crucial in managing claims effectively.