The world of cryptocurrency continues to evolve, with innovative fundraising methods emerging to support new projects. Among these, Initial DEX Offerings (IDOs) have gained significant traction as a decentralized alternative to traditional crowdfunding models. If you’re curious about how IDOs work or considering launching one, this guide breaks down everything you need to know.

What Exactly is an IDO?

An Initial DEX Offering (IDO) enables blockchain projects to raise capital by selling tokens directly to investors through decentralized exchanges (DEXs). Unlike traditional funding methods, IDOs eliminate intermediaries, offering greater transparency, lower costs, and immediate liquidity. This approach has become a preferred choice for startups looking to engage a global investor base without relying on centralized platforms.

The IDO Process Simplified

For beginners, the IDO process can be broken into five key stages:

- Project Preparation – Teams outline their goals, select a DEX or launchpad, and finalize tokenomics.

- Smart Contract Deployment – Tokens are created and programmed with automated distribution rules.

- Token Sale – Investors purchase tokens using cryptocurrencies, often at a fixed or tiered price.

- Liquidity Activation – Tokens become tradable immediately on the DEX, ensuring market access.

- Post-Launch Engagement – Projects focus on community growth, partnerships, and development milestones.

Popular platforms for hosting IDOs include Uniswap, PancakeSwap, and Polkastarter, each offering unique advantages for token launches.

Must-Have Features of a Successful IDO Platform

For those developing an IDO launchpad, certain features are non-negotiable:

- Multi-Chain Support – Compatibility with networks like Ethereum, BSC, or Solana broadens accessibility.

- Secure Wallet Integration – Built-in wallets simplify transactions and enhance security for users.

- Regulatory Compliance – KYC/AML protocols ensure adherence to legal standards.

- User-Friendly Interface – Intuitive dashboards help both projects and investors track progress.

- Anti-Scam Measures – Vesting schedules prevent token dumping, protecting early supporters.

- Community Tools – Social features like forums and live chats foster engagement.

IDO vs. ICO vs. IEO: Key Differences

While IDOs, ICOs (Initial Coin Offerings), and IEOs (Initial Exchange Offerings) all serve as fundraising tools, their execution varies:

- ICOs are decentralized but lack liquidity guarantees.

- IEOs rely on centralized exchanges, offering security but less autonomy.

- IDOs combine decentralization with instant liquidity, striking a balance between efficiency and transparency.

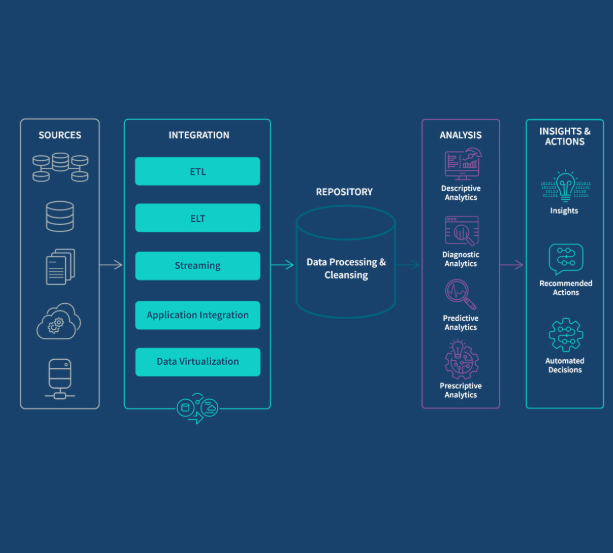

Steps to Launching Your IDO Platform

For teams aiming to build a scalable IDO solution, here’s a structured approach:

- Define Objectives – Align the platform’s features with your target audience and compliance needs.

- Choose Blockchains – Opt for networks that support scalability and user demand.

- Design Tokenomics – Plan supply, distribution, and incentives carefully.

- Develop the Platform – Integrate core features like smart contracts and real-time analytics.

- Test Rigorously – Conduct security audits to eliminate vulnerabilities.

- Launch & Iterate – Monitor performance post-deployment and refine based on feedback.

Final Thoughts

IDOs represent a dynamic shift in crypto fundraising, empowering projects and investors alike. While the model offers clear advantages, success hinges on thoughtful execution—whether you’re participating in an IDO or building a launchpad. For those ready to dive deeper, partnering with experienced developers can streamline the journey from concept to reality.

By staying informed and leveraging best practices, you’ll be well-equipped to navigate the exciting yet complex landscape of decentralized finance.