Decentralized governance is increasingly recognized as a crucial driver of growth for Web3 businesses. As the Web3 ecosystem matures, more startups are leveraging decentralized decision-making to scale efficiently and manage complexities. This blog explores how founders can adopt strategic decentralization, balance stakeholder interests, and avoid common pitfalls that have hindered other projects. Using case studies from Optimism’s retroactive funding model, Uniswap’s delegate system, and MakerDAO’s restructuring, we provide actionable insights for using governance as a growth engine.

Introduction: The Power of Decentralized Governance

In Web3, the idea of giving up control to gain scale may seem counterintuitive, but it’s a guiding principle for successful decentralized organizations. While Web2 companies often prioritize centralization for ease of control, Web3 projects understand that decentralization, if executed thoughtfully, creates powerful network effects that centralization cannot replicate.

However, the journey to successful governance is not without its challenges. Many projects, despite their potential, have collapsed due to voter apathy, governance capture, or regulatory uncertainty. In this blog, we move beyond theoretical concepts and focus on the practical strategies Web3 founders can use to turn governance into a competitive advantage.

Implementing Progressive Decentralization

Decentralization is often misunderstood as an either-or scenario: fully centralized control or complete decentralization. In reality, the most successful Web3 projects embrace progressive decentralization. This approach involves gradually transferring decision-making power to the community over time, ensuring stability in early stages while laying the groundwork for future scalability.

1. Start Centralized, Decentralize Strategically

It might sound appealing to go fully decentralized from the start, but in practice, this often leads to inefficiencies. A more effective strategy is progressive decentralization. This allows founders to retain control during critical early stages, ensuring flexibility and the ability to adapt quickly while involving the community as the project matures.

Example: Optimism began with a centralized foundation managing upgrades and key decisions. As the project evolved, it introduced a Token House for protocol parameters and a Citizens’ House for funding public goods. This phased approach ensured security and stability as the project scaled.

The Three Phases of Decentralization

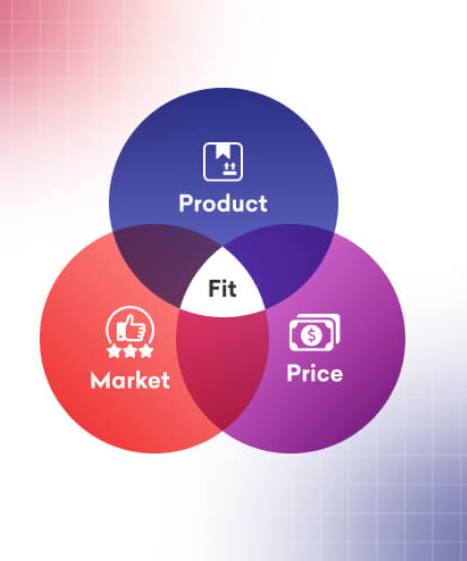

Phase 1: Founder-Led (Product-Market Fit)

In the early stages, founders should maintain control to focus on building the product and achieving product-market fit. This phase is vital for rapid decision-making without the delays caused by community votes. However, founders should create a clear governance roadmap, outlining when and how decentralization will occur.

Example: Arbitrum launched under the control of Offchain Labs in 2021. After securing significant market share, it transitioned to a DAO with the introduction of the ARB token in 2023.

Phase 2: Hybrid Governance (Community Participation)

As the project gains traction, it’s time to delegate specific decisions to token holders while retaining control over crucial areas like upgrades and strategic changes. Implementing governance mining programs can incentivize participation by rewarding users for active engagement, not just token holdings.

Example: dYdX uses a hybrid governance model, where token holders vote on operational matters like fees, while the core team manages protocol upgrades to ensure stability.

Phase 3: DAO-Led (Full Decentralization)

Once the protocol is stable, the final step is transitioning to full community-led governance. This may involve specialized sub-DAOs or working groups focused on specific areas like treasury management or product development. At this stage, robust governance structures, such as constitutions or delegation systems, are needed to maintain efficiency and prevent overwhelming token holders with excessive decision-making.

Example: MakerDAO’s “Endgame Plan” introduced MetaDAOs, specialized sub-DAOs that handle areas like treasury and product development, promoting decentralization without losing operational efficiency.

Governance Mechanisms to Accelerate Growth

When implemented strategically, decentralized governance can become a powerful tool for Web3 businesses. The right governance mechanisms align incentives, encourage participation, and create long-term value by securing user loyalty and attracting developers. Below, we explore four governance mechanisms that have been proven to drive growth.

1. Modular Governance

Why It Matters:

Modular governance adapts decision-making processes as a project evolves, without requiring disruptive changes or complete overhauls. This approach allows Web3 businesses to scale their governance system in alignment with the project’s growth.

How It Drives Growth:

It facilitates quicker decision-making in early stages while maintaining the flexibility needed as the project matures. Modular governance also reduces the risk of needing disruptive forks by allowing for incremental governance updates.

Example: Aragon OSx enables DAOs to customize their governance systems with modular components like multi-sig approvals and optimistic voting, providing flexibility and scalability.

2. Hypercert-Driven Funding

Why It Matters:

Hypercerts tokenize contributions into verifiable on-chain certificates, enabling DAOs to allocate funding based on actual impact rather than speculative promises. This approach ensures efficient treasury use while rewarding high-impact contributions.

How It Drives Growth:

By linking rewards to tangible outcomes, hypercerts build trust and incentivize transparent funding. This method also creates a liquid market for impact-focused capital through the trading of hypercerts.

Example: Gitcoin’s Hypercerts allow contributors to tokenize their work, facilitating retroactive funding for impactful contributions. These tokens have been used in Gitcoin Grants to support public goods projects.

3. Dynamic Delegation

Why It Matters:

Dynamic delegation adapts voting power based on real-time activity and expertise, ensuring that governance remains responsive and meritocratic. It prevents stagnation by reducing the power of inactive delegates and promotes specialized expertise.

How It Drives Growth:

By empowering active, informed participants, dynamic delegation encourages quality proposals and ensures governance decisions are made by the most qualified individuals.

Example: Balancer’s veBAL system requires users to lock liquidity pool tokens to gain voting power, which decays over time. Users can delegate votes to trusted entities, ensuring that governance remains responsive and meritocratic.

4. Reputation-Based Governance

Why It Matters:

Reputation-based governance shifts focus from token holdings to non-financial contributions like community involvement and technical expertise. This system rewards social capital, helping to build more inclusive and diverse governance structures.

How It Drives Growth:

Reputation-based systems incentivize quality engagement by giving voting power to contributors based on their expertise and social capital, not just their financial stake in the project.

Example: Lens Protocol, a decentralized social media platform on Polygon, integrates reputation-based governance to empower users through community-driven decision-making.

Final Thoughts

Decentralized governance is more than a philosophical ideal; it’s a key growth driver for Web3 businesses. By implementing innovative governance mechanisms such as modular governance, dynamic delegation, and reputation-based systems, founders can foster participation, build trust, and scale their projects sustainably.

For Web3 startups, understanding and leveraging governance strategies is essential. By adopting these practices and learning from industry leaders, founders can ensure that their projects are not only successful but also resilient in the fast-evolving Web3 landscape.