Tokenomics plays a vital role in the success of Web3 projects, serving as the foundation for how a project’s token is created, distributed, and governed. While it’s easy to get caught up in the excitement of short-term speculation, the real challenge is building tokenomics that create sustainable value. This article explores how to design tokenomics that withstand the hype-driven cycles and foster lasting engagement and trust from your community.

Understanding the Importance of Robust Tokenomics

In the traditional business world, success hinges on a solid value proposition and smart capital allocation. For Web3 projects, tokenomics takes this a step further by dictating how the token generates and circulates value within the ecosystem. If not properly designed, tokenomics can have several negative effects:

- Price Volatility: An unbalanced supply-demand dynamic leads to extreme price fluctuations.

- Loss of Community Trust: Over-allocation of tokens to early investors or founders can create skepticism.

- Regulatory Issues: Vague token utility and structure can lead to legal scrutiny.

Conversely, well-designed tokenomics promotes active user participation, incentivizes long-term holding, and builds a fair ecosystem that can thrive despite market fluctuations.

Striking the Right Balance Between Supply and Demand

When designing tokenomics, it’s important to manage not only how many tokens are in circulation but also the timing of their release, their inflation rate, and mechanisms for maintaining scarcity. Here’s how to approach it:

- Vesting Schedules: Token release schedules that gradually unlock tokens discourage quick sell-offs and speculative behaviors.

- Inflation and Burn Mechanisms: Controlled inflation supports ecosystem development, while a burn mechanism helps reduce the overall supply and prevent dilution.

Demand is primarily driven by the utility of the token. If tokens are tied to platform features, such as staking rewards or governance participation, it creates ongoing demand. By strategically managing supply and demand, you can prevent short-term market fluctuations from affecting your project’s long-term success.

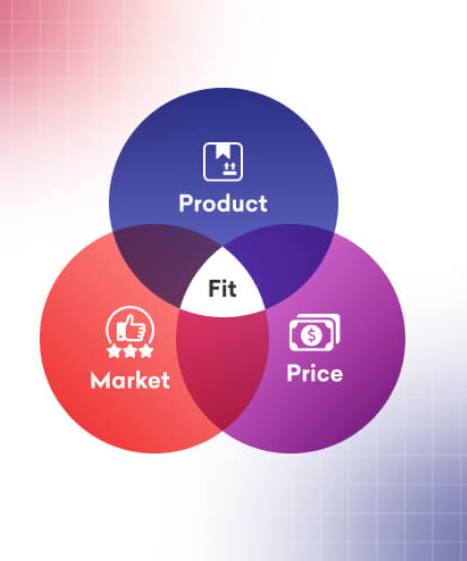

Ensuring Utility Beyond Speculative Hype

Merely having a token is not enough to ensure success. The token must serve a real function within the ecosystem. Without clear utility, speculative demand may cause token prices to rise sharply, only to crash once the hype fades. To anchor token value, ensure that its utility is tied to real-world use cases:

- Transactional Utility: Using tokens for platform services or transactions naturally increases demand as users interact more with the platform.

- Access to Features: Offering exclusive features or services tied to token ownership can create long-term value for holders.

- DeFi Integrations: By collaborating with DeFi protocols for liquidity or yield farming, the token can gain increased utility and expand its reach.

Focusing on long-term utility and user commitment ensures that the token retains value even if speculative interest wanes.

Fair and Transparent Distribution: A Key to Building Trust

The token distribution phase is crucial in establishing credibility and trust within the community. A few key principles to keep in mind:

- Equitable Allocation: Use public sales, airdrops, or community rewards to ensure a broad and fair distribution of tokens.

- Lock-ups and Vesting: Prevent large holders from dumping their tokens all at once by instituting lock-ups or vesting schedules.

- Transparency: Regular updates on token release and project milestones help maintain confidence among investors and stakeholders.

By following these principles, projects can foster a community that feels involved and valued, which is essential for long-term growth.

Governance: Turning Investors into Active Stakeholders

One of the unique features of Web3 projects is decentralized governance, where token holders have a say in the project’s development. This approach transforms passive investors into engaged stakeholders. Here’s how token governance encourages active participation:

- Idea Contribution: Token holders can provide valuable feedback for product improvements, given their first-hand experience.

- Organic Promotion: When users have a vested interest, they become natural ambassadors for the project.

- Long-Term Engagement: Governance participants are more likely to hold their tokens and actively contribute, strengthening the project over time.

However, designing an effective governance structure requires careful planning around voting incentives and quorum thresholds to avoid control by a small group.

Future-Proofing Through Flexible Tokenomics

Crypto markets are volatile and can change rapidly due to external factors such as regulatory shifts or unexpected events. To safeguard your project against such uncertainties, adopt an adaptive approach to tokenomics:

- Algorithmic Adjustments: Dynamic parameters, such as transaction fees or mint/burn rates, can help stabilize token prices during market fluctuations.

- Reserve Protocols: Setting aside funds in stablecoin reserves or treasuries ensures that the project can weather sudden market shocks.

- Continuous Improvements: Regularly update smart contract parameters based on community feedback and market conditions.

Building an agile tokenomics framework allows your project to respond to emerging risks and capitalize on new opportunities.

Conclusion

Tokenomics is a cornerstone of any Web3 project, shaping user engagement, fostering community trust, and ensuring long-term success. By focusing on fair distribution, real utility, transparent governance, and adaptive mechanisms, you can create a token that stands the test of time. As Web3 continues to evolve, staying ahead of trends like governance innovations and cross-chain functionality will be key to building a resilient token economy. By emphasizing long-term value, your project can thrive in a space often dominated by fleeting speculative interests.