Cryptocurrency has long moved beyond its origins in niche communities, gaining widespread acceptance from global trading platforms to small local businesses. As it continues to evolve, cryptocurrency and the blockchain technology behind it offer tremendous benefits to businesses, including the ability to process transactions quickly and at a lower cost. In particular, crypto payment gateways are essential for businesses wanting to harness these benefits and provide customers with a seamless and secure method to make transactions using digital currencies.

In this article, we’ll explore how to build a secure, scalable, and future-ready cryptocurrency payment gateway. We’ll guide you through the key steps and considerations involved in creating a platform that fits your business needs while ensuring safety and efficiency.

Understanding the Function of Crypto Payment Gateways

A cryptocurrency payment gateway is a system that enables businesses to accept payments in digital currencies, such as Bitcoin, Ethereum, and stablecoins like USDT or USDC. These platforms differ significantly from traditional payment systems in that they operate on decentralized blockchain networks, eliminating the need for third-party intermediaries like banks. As a result, crypto payment gateways offer faster, more cost-efficient transactions that are accessible to a global customer base.

Key features of a crypto payment gateway include:

- Decentralized Processing: The use of blockchain technology ensures there is no central authority controlling transactions, reducing the risk of censorship or failure points.

- Multi-Currency Support: Unlike conventional systems that typically support only one currency, crypto gateways accommodate a variety of digital currencies, offering greater flexibility to merchants and customers alike.

- Real-Time Conversion: Given the volatile nature of cryptocurrencies, some gateways automatically convert digital currencies into fiat currency during the transaction, shielding merchants from price swings.

- Transaction Monitoring: Blockchain’s transparency allows merchants to track transactions from initiation to confirmation, aiding in dispute resolution and troubleshooting.

- Security Measures: These gateways employ robust security protocols such as encryption, secure wallet infrastructures, and compliance with KYC/AML regulations to ensure safe and legitimate transactions.

Why Your Business Should Consider Crypto Payment Gateways

There are several advantages to integrating a crypto payment gateway into your business model:

- Global Reach: Cryptocurrency allows businesses to accept payments from anywhere, making it easier to serve international customers without worrying about currency conversions.

- Lower Transaction Costs: Blockchain technology cuts out the middleman, resulting in lower processing fees, particularly for international transactions.

- No Chargebacks: Crypto transactions are irreversible, minimizing the risk of chargebacks and fraud, which can be a significant problem for merchants using traditional payment methods.

- Enhanced Privacy and Control: Crypto payments require minimal personal information, increasing privacy for users and reducing merchants’ compliance burdens.

- Faster Settlements: Transactions are often completed within minutes or seconds, improving cash flow for merchants.

Steps to Build a Secure Cryptocurrency Payment Gateway

Creating a secure and efficient crypto payment gateway involves several steps, each critical to ensuring the system’s functionality and safety.

1. Market Research and Feasibility Study

Before starting the development process, conduct comprehensive market research to understand the landscape of the crypto payment industry. This step helps identify potential customers, competitor strengths, and gaps in the market that your gateway can address. You’ll also want to analyze trends in cryptocurrency adoption, preferred digital currencies, and the security concerns of your target audience.

Conducting a feasibility study is also essential. This will help determine if developing a crypto payment gateway is technically feasible, financially viable, and operationally manageable. The feasibility study should assess existing infrastructure, estimate development costs, and calculate expected returns on investment. Don’t forget to account for the time to market and regulatory challenges.

2. Legal and Regulatory Compliance

Navigating the legal landscape is a significant challenge when developing a crypto payment gateway. Depending on where your business operates, different countries have varying rules about cryptocurrency. It is essential to understand whether cryptocurrency is classified as a currency, commodity, or security, as this will determine which laws you need to comply with.

You’ll also need to familiarize yourself with international regulations, such as GDPR, PCI DSS, and anti-money laundering (AML) requirements. It’s advisable to consult with legal professionals who specialize in cryptocurrency regulations to avoid potential legal pitfalls.

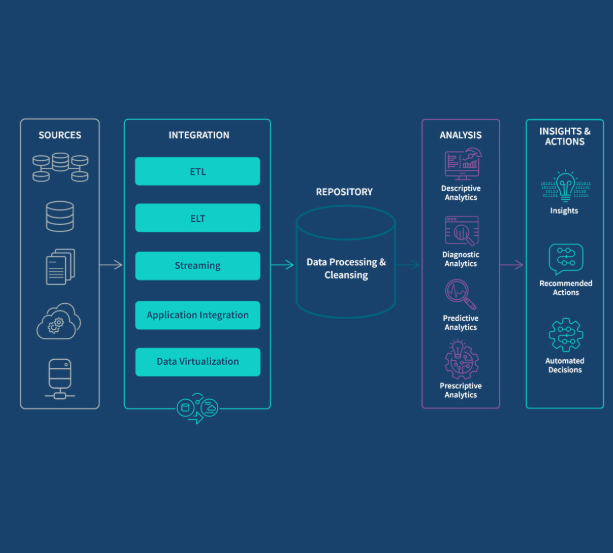

3. Architecture and Infrastructure Design

The next step is to establish the architecture and infrastructure of your payment gateway. This includes deciding on the microservices model, which divides core functionalities (like transaction processing, wallet management, and KYC checks) into independent services. This modular approach makes it easier to scale and upgrade the platform over time.

Key infrastructure components include:

- Blockchain nodes to interact with various networks

- Database systems for storing user and transaction data securely

- Wallet infrastructure to manage crypto assets

- API gateways to allow easy integration with external systems

- Monitoring tools for real-time system performance tracking

4. Smart Contract and Wallet Integration

Smart contracts play a crucial role in ensuring secure and automated transactions on the blockchain. When designing smart contracts, they must be secure, auditable, and upgradeable. Components such as escrow functionality, fee logic, and refund mechanisms should be built into the contract.

When it comes to wallet integration, decide whether you will offer custodial or non-custodial wallets. Custodial wallets are easier to manage but carry regulatory risks and vulnerabilities. Non-custodial wallets offer better privacy and security, as users control their private keys, but they may be more difficult for new users to navigate.

5. Payment Flow and Transaction Management

The payment flow should be simple yet secure, involving the following steps:

- The customer selects cryptocurrency at checkout, and the merchant’s system generates a payment request.

- The customer’s wallet processes the transaction and broadcasts it to the blockchain.

- The blockchain validates the transaction, and the merchant receives confirmation.

- If needed, the cryptocurrency is converted to fiat.

To ensure smooth payment processing, the system should support real-time transaction monitoring, multi-currency transactions, and cross-blockchain capabilities. Furthermore, reconciliation and reporting tools are essential for resolving disputes and tracking payment records.

6. Security Best Practices

Security is paramount when developing a cryptocurrency payment gateway. Blockchain transactions are irreversible, so any vulnerabilities in the system can lead to severe financial losses. Adopting a multi-layered defense strategy is essential, including:

- Private key management to ensure safe storage of private keys

- End-to-end encryption to protect data during transmission

- Secure authentication and access control to prevent unauthorized access

- Regular monitoring and logging to detect potential threats in real time

- Incident response plans to quickly address security breaches

Additionally, regularly updating your gateway’s security protocols and conducting third-party audits will help ensure ongoing protection.

7. Blockchain Integration and Wallet Management

Selecting the right blockchain networks to support is critical to the success of your gateway. Popular options include Bitcoin, Ethereum, and Solana, among others. Each network has its own set of protocols and client implementations, so ensure you choose the right one for your platform’s needs.

Wallet management is also crucial. Decide whether you’ll support custodial or non-custodial wallets, or a hybrid solution that allows users to choose between the two. Implement robust backup and recovery systems to ensure assets are protected in case of system failure.

8. Testing and Deployment

Before going live, thorough testing is crucial to ensure the gateway functions properly under various conditions. This should include unit testing to validate individual components, integration testing for payment flow, and security testing to identify vulnerabilities. Once testing is complete, deploy the platform using a continuous integration/continuous deployment (CI/CD) pipeline to streamline updates and ensure consistency between development and production environments.

Conclusion: The Complexity of Developing a Crypto Payment Gateway

Building a secure cryptocurrency payment gateway is no simple task. It requires careful planning, market research, legal compliance, and the integration of various technologies and security measures. Only with the right team of experienced professionals can you create a platform that meets the needs of your customers while ensuring high levels of security and efficiency.

By following the outlined steps and best practices, you can create a crypto payment gateway that not only serves your business’s needs but also provides a seamless and secure payment experience for your customers.