The rise of decentralized finance (DeFi) has led to significant changes in how cryptocurrency transactions occur. Peer-to-peer (P2P) cryptocurrency platforms, which eliminate the need for intermediaries, have gained popularity due to their enhanced privacy, cost efficiency, and increased control over financial activities. However, developing a P2P exchange platform presents unique regulatory and legal challenges. Entrepreneurs in this space must ensure that their platforms comply with various legal requirements to maintain their business’s long-term viability.

As the digital currency market evolves, regulatory bodies around the world are working to create frameworks to govern crypto transactions. Understanding these regulations and adhering to them is vital for any business looking to develop or operate a P2P exchange. This article will explore the legal considerations and regulatory measures necessary to build a compliant and successful P2P exchange platform.

Navigating the Regulatory Landscape

A crucial first step in building a compliant P2P exchange is understanding the global regulatory environment. Since these platforms operate in a decentralized manner, they face heightened scrutiny from financial regulators. Failing to comply with relevant regulations can result in severe penalties, including platform shutdowns or criminal charges.

Licensing and Registration

Before launching a P2P exchange, it’s essential to secure the appropriate licenses based on the jurisdictions served. This step is necessary to ensure that the platform operates legally and protects both users and operators. For example, in the United States, P2P exchanges must register as Money Services Businesses (MSBs) with the Financial Crimes Enforcement Network (FinCEN), and many states require individual licenses to operate across multiple jurisdictions.

Similarly, platforms must comply with the Financial Action Task Force (FATF) guidelines, which require exchanges to register as Virtual Asset Service Providers (VASPs). These platforms must also implement Anti-Money Laundering (AML) and Counter-Terrorism Financing (CFT) protocols to maintain compliance.

If the exchange deals with securities such as crypto derivatives, it must adhere to local securities laws, acquire special permits, and undergo more stringent audits. Additionally, countries like Switzerland and Singapore have crypto-friendly regulations, whereas others like China have imposed bans. Therefore, understanding the jurisdictional landscape is essential for ensuring legal compliance.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Policies

AML and KYC policies are fundamental to combating fraud, money laundering, and the financing of terrorism. A P2P exchange must implement these measures throughout the user experience. This includes gathering and verifying personal information, such as government-issued IDs and utility bills, to ensure that only legitimate users have access to the platform.

Transaction monitoring systems are also necessary to flag suspicious activities, and platforms must be prepared for regular audits and reporting to regulatory authorities. Sanctions screening tools should also be integrated to ensure that individuals from sanctioned countries do not use the platform.

Data Protection and Privacy Laws

P2P exchanges handle sensitive financial data, making data protection a key priority. Compliance with data protection regulations, such as the General Data Protection Regulation (GDPR) for European Union citizens and the California Consumer Privacy Act (CCPA) for residents of California, is essential.

Exchanges must use strong encryption methods, perform regular security audits, and ensure that third-party vendors also meet data protection standards. Protecting user privacy helps maintain trust and ensures that the platform avoids hefty fines for non-compliance.

Consumer Protection

P2P exchanges must establish transparent and user-friendly policies to foster trust within the decentralized trading environment. This includes clear and accessible terms of service, transparent fee structures, and effective dispute resolution mechanisms. Implementing escrow services and customer support channels can help resolve user disputes efficiently.

The platform must also establish procedures for handling complaints, refunds, and account suspensions in accordance with consumer protection laws.

Legal Considerations for P2P Exchange Development

Beyond technical features, developers must also consider the legal framework in which their platform will operate. Below are several critical legal aspects to address when building a P2P exchange.

Choosing the Right Jurisdiction

The jurisdiction in which the platform operates influences everything from tax obligations to regulatory compliance. It is essential to choose a jurisdiction with clear, progressive regulations for cryptocurrency businesses to avoid sudden policy shifts, potential bans, or legal troubles.

Additionally, tax treatment for cryptocurrencies varies by country, and some regions offer tax incentives for crypto-related businesses. Platforms should carefully evaluate their tax responsibilities and the market potential in different regions.

Intellectual Property Protection

Protecting intellectual property (IP) is vital in the competitive cryptocurrency market. Developers should register trademarks for the platform’s name, logo, and other distinctive elements. Furthermore, any proprietary technology used in the exchange should be patented to protect against unauthorized use.

Platforms must also ensure that any third-party software or solutions are licensed correctly to avoid potential legal issues.

Contractual Agreements

Clear, legally binding contracts are crucial for defining the relationship between the platform, its users, and business partners. P2P exchanges must draft user agreements outlining responsibilities, acceptable activities, and dispute resolution procedures. Privacy policies should also comply with regulations like GDPR and CCPA.

Partnership agreements are also necessary if the platform collaborates with external service providers such as payment gateways, blockchain analytics firms, or liquidity providers. These agreements should specify service-level guarantees, data protection measures, and legal indemnities.

Ensuring Technical Compliance

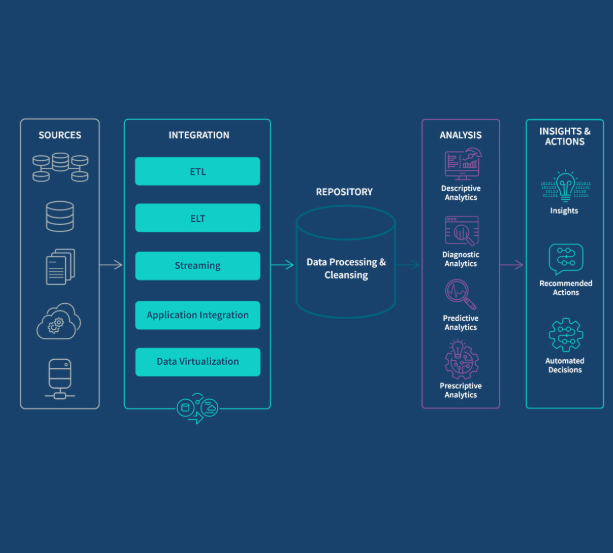

Technical infrastructure plays a pivotal role in maintaining regulatory compliance for a P2P exchange. A secure, scalable, and compliant platform is crucial for protecting user data, meeting regulatory requirements, and supporting high-volume trading.

Secure Platform Architecture

Security should be at the core of any P2P exchange. Depending on whether the platform is centralized, decentralized, or hybrid, the appropriate security measures must be implemented. Centralized elements require rigorous cybersecurity protocols, such as two-factor authentication (2FA), cold storage for crypto assets, and real-time threat monitoring.

Decentralized exchanges benefit from protocols that minimize single points of failure and enhance user privacy. Hybrid models combine the best of both centralized and decentralized features, offering both security and compliance.

Compliance with Financial Regulations

A P2P exchange must also comply with financial regulations. This includes ensuring transparency in market-making services and meeting the reporting and auditing requirements for over-the-counter (OTC) trades. Transaction tracking systems and real-time logging are essential for maintaining compliance with global financial standards.

Best Practices for Regulatory Compliance

To stay compliant with evolving regulations, P2P exchanges should:

- Consult with legal experts who specialize in cryptocurrency regulations.

- Continuously monitor global regulatory developments.

- Implement a robust compliance program, including AML, KYC, and data protection strategies.

- Educate users on the platform’s compliance policies and requirements.

Conclusion

Building a successful P2P cryptocurrency exchange involves more than just launching a platform; it requires careful attention to regulatory and legal requirements. By understanding global compliance frameworks and implementing the necessary technical and legal measures, a P2P exchange can thrive in an increasingly regulated digital market. Failing to address these legal essentials could lead to fines, shutdowns, or reputational damage, underscoring the importance of maintaining strict compliance in the crypto space.