The importance of data compliance in financial institutions has never been greater. With the rise of stringent privacy regulations like GDPR and CCPA, alongside growing cyber threats, managing compliance has become more complex than ever. Financial institutions are now seeking a balanced approach that not only ensures regulatory compliance but also fosters growth and trust.

In this blog, we explore how a data-driven model supported by strong data management practices and emerging technologies is transforming the way financial institutions approach compliance and security.

The Challenge of Data Compliance

Data plays a central role in the operations of financial institutions, driving everything from transactions to customer interactions. However, this data is subject to strict regulations that make compliance a significant challenge. Ensuring compliance is no longer just about ticking boxes—it’s crucial for maintaining customer trust and safeguarding the institution’s reputation.

Given the increasing volume of data, siloed information, and ever-evolving regulations, traditional compliance approaches are becoming outdated and risky. Financial institutions need a more dynamic and efficient system for managing their compliance requirements.

Data Classification: A Key Defense Strategy

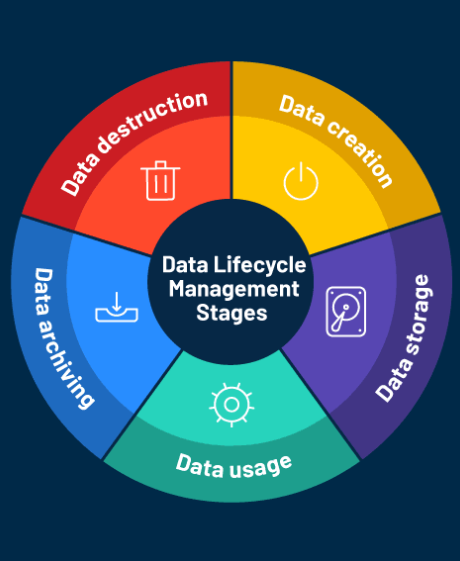

Understanding and categorizing data is the first step in overcoming compliance challenges. Effective data classification is essential for financial institutions to ensure that they manage data according to its sensitivity and the relevant regulations. By organizing data properly, institutions can implement strong safeguards and ensure compliance with regulations while protecting sensitive information.

Data classification helps institutions build a clear structure for handling different types of data, enabling them to apply the right policies and controls based on the data’s importance and legal requirements.

Proactive Compliance Management with Data Governance

Data governance is at the heart of a strong compliance strategy. It involves defining roles and responsibilities, streamlining workflows, and using appropriate technology to secure data. Financial institutions that prioritize data governance can improve efficiency, enhance accountability, and streamline their compliance efforts.

A comprehensive governance framework not only ensures regulatory compliance but also contributes to effective data management. By integrating governance practices, institutions can create a robust compliance environment that benefits both operational efficiency and security.

Utilizing Technology for Streamlined Compliance

As the regulatory landscape becomes increasingly complex, financial institutions are turning to technology to improve compliance. Tools such as Artificial Intelligence (AI), Machine Learning (ML), and Automation are becoming essential for managing compliance tasks efficiently.

These technologies offer several advantages, including the ability to identify sensitive data, detect anomalies, and automate routine compliance processes. AI, for instance, can help institutions identify potential risks early, enabling them to take proactive measures to address issues before they escalate.

Enhancing Agility with AI and Automation

Adopting a data-driven approach to compliance allows financial institutions to gain more than just regulatory adherence—it fosters business growth and enhances customer trust. By integrating AI and automation into their compliance strategies, these institutions can not only comply with current regulations but also stay agile and adaptable in the face of changing legal requirements.

The future of data compliance will require continuous monitoring and adaptation. As financial institutions embrace this new, technology-driven model, they can ensure compliance while improving business operations and customer security.

Ethical Considerations in Compliance

While pursuing compliance, financial institutions must also remain committed to the highest ethical standards. In a sector that plays a critical role in the global economy, institutions must handle data responsibly and ethically, going beyond regulatory requirements to build trust with their customers and stakeholders.

Institutions that prioritize both compliance and ethical practices position themselves not just to succeed in the present but to establish a positive legacy for the future. Upholding ethical standards in data management builds long-term trust and fosters respect across all levels of the organization.

The Path Forward: Proactive, Adaptive, and Ethical Compliance

The regulatory landscape for financial institutions is tough, with strict regulations and increasing cyber threats. However, for those ready to adopt a more proactive approach—one that views data as essential to security and responsibility—the rewards are significant.

Financial institutions can achieve superior compliance by integrating strategies like data classification, governance, automation, and ethical management. By combining these strategies, they can not only enhance security and flexibility but also build greater trust with customers, ensuring they are well-prepared to thrive in the increasingly data-driven future.